| Zacks Company Profile for HealthStream, Inc. (HSTM : NSDQ) |

|

|

| |

| • Company Description |

| HealthStream's suite of solutions is contracted by healthcare employees in the U.S. for workforce development, training & learning management, talent management, credentialing, privileging, provider enrollment, performance assessment and managing simulation-based education programs. HealthStream has additional offices in Jericho, New York; Boulder, Colorado; Denver, Colorado; San Diego, California; Chicago, Illinois; Portland, Oregon; and Raleigh, North Carolina.

Number of Employees: 1,093 |

|

|

| |

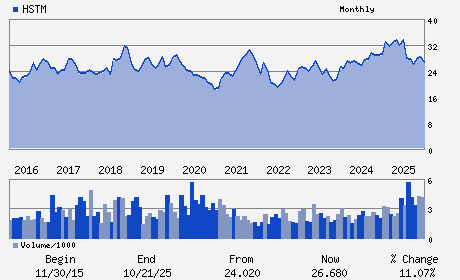

| • Price / Volume Information |

| Yesterday's Closing Price: $21.23 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 415,126 shares |

| Shares Outstanding: 29.67 (millions) |

| Market Capitalization: $629.85 (millions) |

| Beta: 0.44 |

| 52 Week High: $34.13 |

| 52 Week Low: $19.50 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.32% |

-2.06% |

| 12 Week |

-14.08% |

-14.36% |

| Year To Date |

-7.98% |

-8.39% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Robert A. Frist - Chief Executive Officer and Chairman

Scott A. Roberts - Chief Financial Officer and Senior Vice President

Thompson Dent - Director

Frank Gordon - Director

Terry Allison Rappuhn - Director

|

|

Peer Information

HealthStream, Inc. (BIZZ)

HealthStream, Inc. (DCLK)

HealthStream, Inc. (DGIN.)

HealthStream, Inc. (DVW)

HealthStream, Inc. (CYCHZ)

HealthStream, Inc. (IFXC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SERVICES

Sector: Computer and Technology

CUSIP: 42222N103

SIC: 7370

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 29.67

Most Recent Split Date: (:1)

Beta: 0.44

Market Capitalization: $629.85 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.58% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.17 |

Indicated Annual Dividend: $0.12 |

| Current Fiscal Year EPS Consensus Estimate: $0.75 |

Payout Ratio: 0.18 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.08 |

| Estmated Long-Term EPS Growth Rate: 12.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |