| Zacks Company Profile for Iberdrola S.A. (IBDRY : OTC) |

|

|

| |

| • Company Description |

| IBERDROLA, S.A. operates as an energy group, which provides utilities and wind power. It is primarily involved in electricity distribution, gas distribution and telecommunications. In electricity distribution segment, it plans, develops and operates the distribution network, provides the service within regulatory quality of service, measures usage at the supply points, bills access and full rates until the last resort rate is established and runs demand management programmes. The main work of gas distribution segment involves carrying gas from the network to the end user's installation. The Company also operates telecommunications infrastructure which consists of different networks such as backbone (fibre optic and PLC), transmission, data-switching, voice-switching and radio. IBERDROLA, S.A is based in Bilbao, Spain.

Number of Employees: 40,000 |

|

|

| |

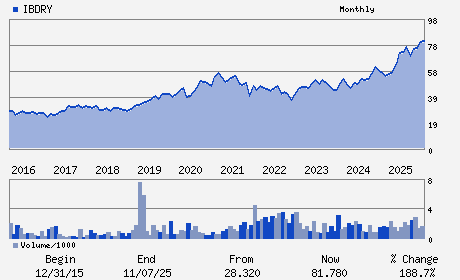

| • Price / Volume Information |

| Yesterday's Closing Price: $94.50 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 103,678 shares |

| Shares Outstanding: 1,670.31 (millions) |

| Market Capitalization: $157,843.98 (millions) |

| Beta: 0.71 |

| 52 Week High: $96.50 |

| 52 Week Low: $57.24 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.63% |

5.54% |

| 12 Week |

12.77% |

12.63% |

| Year To Date |

9.38% |

8.84% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Armando Martinez Martinez - Chief Executive Officer

Jose Ignacio Sanchez Galan - Executive chairman

Jose Sainz Armada - Chief Financial Officer

Maria Helena Antolin Raybaud - Director

Xabier Sagredo Ormaza - Director

|

|

Peer Information

Iberdrola S.A. (ELP)

Iberdrola S.A. (CIV)

Iberdrola S.A. (ELPVY)

Iberdrola S.A. (HGKGY)

Iberdrola S.A. (AYE)

Iberdrola S.A. (GMP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: UTIL-ELEC PWR

Sector: Utilities

CUSIP: 450737101

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 1,670.31

Most Recent Split Date: (:1)

Beta: 0.71

Market Capitalization: $157,843.98 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.91% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.80 |

| Current Fiscal Year EPS Consensus Estimate: $4.67 |

Payout Ratio: 0.71 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.28 |

| Estmated Long-Term EPS Growth Rate: 8.71% |

Last Dividend Paid: 01/13/2026 - $0.90 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |