| Zacks Company Profile for IDEXX Laboratories, Inc. (IDXX : NSDQ) |

|

|

| |

| • Company Description |

| IDEXX Laboratories, Inc. is a developer, manufacturer and distributor of products and services primarily for the companion animal veterinary, livestock and poultry, water testing and dairy markets. The company also sells a series of portable electrolytes and blood gas analyzers for the human point-of-care medical diagnostics market.

Number of Employees: 11,000 |

|

|

| |

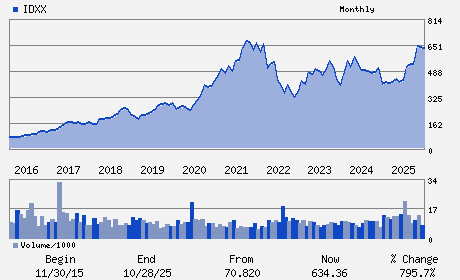

| • Price / Volume Information |

| Yesterday's Closing Price: $656.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 527,168 shares |

| Shares Outstanding: 79.62 (millions) |

| Market Capitalization: $52,291.49 (millions) |

| Beta: 1.66 |

| 52 Week High: $769.98 |

| 52 Week Low: $356.14 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.05% |

-1.19% |

| 12 Week |

-8.03% |

-8.15% |

| Year To Date |

-2.93% |

-3.40% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

ONE IDEXX DRIVE

-

WESTBROOK,ME 04092

USA |

ph: 207-556-0300

fax: 207-556-4346 |

ir@robinhood.com |

http://www.idexx.com |

|

|

| |

| • General Corporate Information |

Officers

Jonathan J. Mazelsky - President; Chief Executive Officer and Director

Lawrence D. Kingsley - Chairman

Andrew J. Emerson - Executive Vice President; Chief Financial Officer

Irene Chang Britt - Director

Bruce L. Claflin - Director

|

|

Peer Information

IDEXX Laboratories, Inc. (ABMD)

IDEXX Laboratories, Inc. (DMDS)

IDEXX Laboratories, Inc. (CPWY.)

IDEXX Laboratories, Inc. (EQUR)

IDEXX Laboratories, Inc. (ECIA)

IDEXX Laboratories, Inc. (FMS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED INSTRUMENTS

Sector: Medical

CUSIP: 45168D104

SIC: 2835

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 79.62

Most Recent Split Date: 6.00 (2.00:1)

Beta: 1.66

Market Capitalization: $52,291.49 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.44 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $14.54 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 11.32% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |