| Zacks Company Profile for IDEAYA Biosciences, Inc. (IDYA : NSDQ) |

|

|

| |

| • Company Description |

| IDEAYA Biosciences Inc. is an oncology-focused precision medicine company. It focuses on the discovery and development of therapeutics for patients using molecular diagnostics. The company's product pipeline consists of IDE196, MAT2A, PARG, Pol-theta and WRN which are in clinical stage. IDEAYA Biosciences Inc. is based in South San Francisco, United States.

Number of Employees: 145 |

|

|

| |

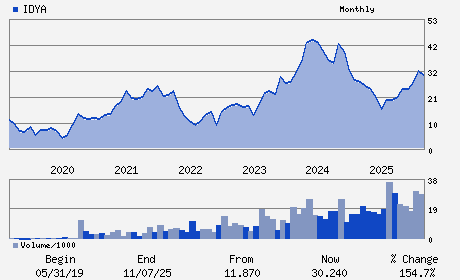

| • Price / Volume Information |

| Yesterday's Closing Price: $32.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 814,535 shares |

| Shares Outstanding: 87.81 (millions) |

| Market Capitalization: $2,827.61 (millions) |

| Beta: 0.10 |

| 52 Week High: $39.28 |

| 52 Week Low: $13.45 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.39% |

-1.12% |

| 12 Week |

-10.58% |

-10.86% |

| Year To Date |

-6.86% |

-8.57% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Yujiro Hata - Chief Executive Officer and President

Terry Rosen - Chairman of the Board

Joshua Bleharski - Chief Financial Officer

Andres Ruiz Briseno - Chief Accounting Officer

Garret Hampton - Director

|

|

Peer Information

IDEAYA Biosciences, Inc. (CORR.)

IDEAYA Biosciences, Inc. (RSPI)

IDEAYA Biosciences, Inc. (CGXP)

IDEAYA Biosciences, Inc. (BGEN)

IDEAYA Biosciences, Inc. (GTBP)

IDEAYA Biosciences, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 45166A102

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 87.81

Most Recent Split Date: (:1)

Beta: 0.10

Market Capitalization: $2,827.61 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-1.07 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-3.90 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |