| Zacks Company Profile for Information Services Group, Inc. (III : NSDQ) |

|

|

| |

| • Company Description |

| INFORMATION SERVICES GROUP, INC. was founded to build an industry-leading, high-growth, information-based services company by acquiring and growing businesses in advisory, data, business and media information services. ISG's first acquisition - TPI, the world's leading data and advisory firm in global sourcing - provides a solid platform upon which to build a prominent, high-growth information-based services company. Based in Stamford, Connecticut, ISG has a proven leadership team with global experience in information-based services and a track record of creating significant value for shareowners, clients and employees. ISG's strategy is to acquire and grow dynamic, innovative businesses that provide `must have` information-based services to such sectors as consumer products, retailing, financial services, manufacturing, media, marketing, healthcare, legal, government, telecommunications and technology.

Number of Employees: 1,323 |

|

|

| |

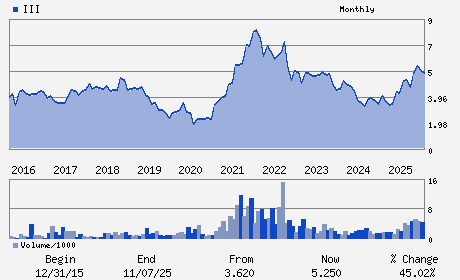

| • Price / Volume Information |

| Yesterday's Closing Price: $4.81 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 353,744 shares |

| Shares Outstanding: 47.88 (millions) |

| Market Capitalization: $230.32 (millions) |

| Beta: 1.07 |

| 52 Week High: $6.45 |

| 52 Week Low: $2.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.65% |

-12.89% |

| 12 Week |

-19.43% |

-19.53% |

| Year To Date |

-16.78% |

-17.19% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael P. Connors - Chairman and Chief Executive Officer

Michael A. Sherrick - Executive Vice President and Chief Financial Offic

Neil G. Budnick - Director

Gerald S. Hobbs - Director

Kalpana Raina - Director

|

|

Peer Information

Information Services Group, Inc. (CEB)

Information Services Group, Inc. (ACCL)

Information Services Group, Inc. (EFX)

Information Services Group, Inc. (NCI.)

Information Services Group, Inc. (TGISQ)

Information Services Group, Inc. (EXPO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Consulting

Sector: Business Services

CUSIP: 45675Y104

SIC: 8742

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 47.88

Most Recent Split Date: (:1)

Beta: 1.07

Market Capitalization: $230.32 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.74% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.05 |

Indicated Annual Dividend: $0.18 |

| Current Fiscal Year EPS Consensus Estimate: $0.27 |

Payout Ratio: 1.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.19 |

| Estmated Long-Term EPS Growth Rate: 18.50% |

Last Dividend Paid: 12/05/2025 - $0.05 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |