| Zacks Company Profile for Internet Initiative Japan, Inc. (IIJIY : OTC) |

|

|

| |

| • Company Description |

| Internet Initiative Japan Inc. offers a comprehensive range of Internet access services and Internet-related services to customers, including corporations and other Internet service providers, in Japan. The company offers its services via one of the largest Internet network backbones in Japan as well as between Japan and the United States. (PRESS RELEASE)

Number of Employees: 5,221 |

|

|

| |

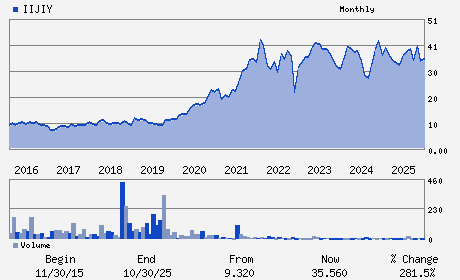

| • Price / Volume Information |

| Yesterday's Closing Price: $28.69 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 492 shares |

| Shares Outstanding: 91.72 (millions) |

| Market Capitalization: $2,631.58 (millions) |

| Beta: 1.19 |

| 52 Week High: $44.71 |

| 52 Week Low: $27.56 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.36% |

-6.55% |

| 12 Week |

-19.41% |

-19.51% |

| Year To Date |

-18.79% |

-19.19% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Iidabashi Grand Bloom 2-10-2 Fujimi Chiyoda-ku

-

TOKYO,M0 102-0071

JPN |

ph: 813-5205-6500

fax: 813-5205-6441 |

ir@iij.ad.jp |

http://www.iij.ad.jp |

|

|

| |

| • General Corporate Information |

Officers

Koichi Suzuki - Chief Executive Officer and Chairman

Eijiro Katsu - President and Director

Yasuhiko Taniwaki - Vice president and Director

Akihisa Watai - Chief Financial Officer

Takashi Tsukamoto - Director

|

|

Peer Information

Internet Initiative Japan, Inc. (BIZZ)

Internet Initiative Japan, Inc. (DCLK)

Internet Initiative Japan, Inc. (DGIN.)

Internet Initiative Japan, Inc. (DVW)

Internet Initiative Japan, Inc. (CYCHZ)

Internet Initiative Japan, Inc. (IFXC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SERVICES

Sector: Computer and Technology

CUSIP: 46059T109

SIC: 7370

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/12/26

|

|

Share - Related Items

Shares Outstanding: 91.72

Most Recent Split Date: (:1)

Beta: 1.19

Market Capitalization: $2,631.58 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.25% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.36 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.21 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/12/26 |

|

|

|

| |