| Zacks Company Profile for Inovio Pharmaceuticals, Inc. (INO : NSDQ) |

|

|

| |

| • Company Description |

| Inovio Pharmaceuticals, Inc., formerly known as Inovio Biomedical Corporation, is engaged in the discovery, development, and delivery of a new generation of vaccines, called DNA vaccines, focused on cancers and infectious diseases. The Company's electroporation DNA delivery technology uses brief, controlled electrical pulses to increase cellular DNA vaccine uptake. Inovio's clinical programs include human papillomavirus (HPV)/cervical cancer (therapeutic), avian influenza (preventative), hepatitis C virus (HCV) and human immunodeficiency virus (HIV) vaccines. It is advancing preclinical research for a universal seasonal/pandemic influenza vaccine. The Company's partners and collaborators include University of Pennsylvania, National Microbiology Laboratory of the Public Health Agency of Canada, NIAID, Merck, ChronTech, University of Southampton, and HIV Vaccines Trial Network. Inovio Pharmaceuticals, Inc. is headquartered in Blue Bell, Pennsylvania.

Number of Employees: 134 |

|

|

| |

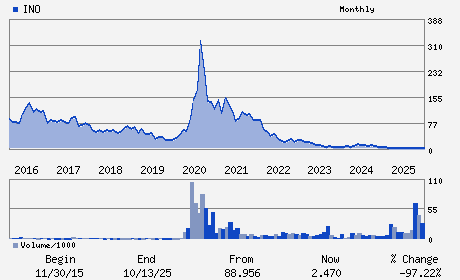

| • Price / Volume Information |

| Yesterday's Closing Price: $1.81 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 976,748 shares |

| Shares Outstanding: 66.73 (millions) |

| Market Capitalization: $120.78 (millions) |

| Beta: 1.70 |

| 52 Week High: $2.98 |

| 52 Week Low: $1.30 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.04% |

12.01% |

| 12 Week |

-12.56% |

-12.67% |

| Year To Date |

4.02% |

3.52% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jacqueline E. Shea - Chief Executive Officer and President

Simon X. Benito - Chairman

Peter Kies - Chief Financial Officer

Roger D. Dansey - Director

Ann C. Miller - Director

|

|

Peer Information

Inovio Pharmaceuticals, Inc. (CORR.)

Inovio Pharmaceuticals, Inc. (RSPI)

Inovio Pharmaceuticals, Inc. (CGXP)

Inovio Pharmaceuticals, Inc. (BGEN)

Inovio Pharmaceuticals, Inc. (GTBP)

Inovio Pharmaceuticals, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 45773H409

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/17/26

|

|

Share - Related Items

Shares Outstanding: 66.73

Most Recent Split Date: 1.00 (0.08:1)

Beta: 1.70

Market Capitalization: $120.78 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.34 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-1.26 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/17/26 |

|

|

|

| |