| Zacks Company Profile for Innovex International, Inc. (INVX : NYSE) |

|

|

| |

| • Company Description |

| Innovex Downhole Solutions Inc. designs, manufactures and installs mission-critical drilling & deployment, well construction, completion, production and fishing & intervention solutions to support upstream onshore and offshore activities. Innovex Downhole Solutions Inc., formerly known as Dril-Quip, is based in HOUSTON.

Number of Employees: 2,160 |

|

|

| |

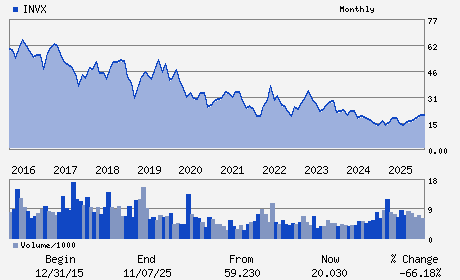

| • Price / Volume Information |

| Yesterday's Closing Price: $26.35 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 650,044 shares |

| Shares Outstanding: 69.14 (millions) |

| Market Capitalization: $1,821.80 (millions) |

| Beta: 0.72 |

| 52 Week High: $29.48 |

| 52 Week Low: $11.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.04% |

6.96% |

| 12 Week |

12.41% |

12.28% |

| Year To Date |

20.49% |

19.90% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Adam Anderson - Chief Executive Officer and Director

Kendal Reed - Chief Financial Officer

John Lovoi - Director

Terence Jupp - Director

Carri Lockhart - Director

|

|

Peer Information

Innovex International, Inc. (WFTIQ)

Innovex International, Inc. (KGS)

Innovex International, Inc. (CAM.1)

Innovex International, Inc. (PGEO)

Innovex International, Inc. (UFAB.)

Innovex International, Inc. (POWR.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL FLD MCH&EQP

Sector: Oils/Energy

CUSIP: 457651107

SIC: 3533

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 69.14

Most Recent Split Date: 10.00 (2.00:1)

Beta: 0.72

Market Capitalization: $1,821.80 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.35 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.58 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |