| Zacks Company Profile for Ionis Pharmaceuticals, Inc. (IONS : NSDQ) |

|

|

| |

| • Company Description |

| Ionis Pharmaceuticals discovers/develops RNA-targeted therapeutics using its proprietary antisense oligonucleotide technology. Its antisense medicines have been developed/are being developed to treat neurological, cardiovascular and specialty rare diseases.

Number of Employees: 1,402 |

|

|

| |

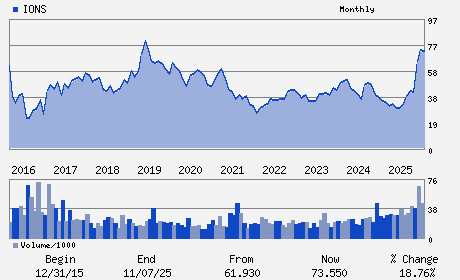

| • Price / Volume Information |

| Yesterday's Closing Price: $81.15 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,046,139 shares |

| Shares Outstanding: 165.19 (millions) |

| Market Capitalization: $13,405.33 (millions) |

| Beta: 0.31 |

| 52 Week High: $86.74 |

| 52 Week Low: $23.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.84% |

-0.98% |

| 12 Week |

-0.65% |

-0.77% |

| Year To Date |

2.58% |

2.08% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2855 GAZELLE COURT

-

CARLSBAD,CA 92010

USA |

ph: 760-931-9200

fax: 760-603-2700 |

ir@ionis.com |

https://ionis.com |

|

|

| |

| • General Corporate Information |

Officers

Brett P. Monia - Chief Executive Officer

Joseph Loscalzo - Chairman of the Board

Elizabeth L. Hougen - Executive Vice President; Finance and Chief Financ

Allene M. Diaz - Director

Joan E. Herman - Director

|

|

Peer Information

Ionis Pharmaceuticals, Inc. (GSAC)

Ionis Pharmaceuticals, Inc. (CASIF)

Ionis Pharmaceuticals, Inc. (ALCD.)

Ionis Pharmaceuticals, Inc. (OMNN)

Ionis Pharmaceuticals, Inc. (CGPI.)

Ionis Pharmaceuticals, Inc. (CATX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-DRUGS

Sector: Medical

CUSIP: 462222100

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 165.19

Most Recent Split Date: (:1)

Beta: 0.31

Market Capitalization: $13,405.33 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.77 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-3.28 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |