| Zacks Company Profile for Interparfums, Inc. (IPAR : NSDQ) |

|

|

| |

| • Company Description |

| Inter Parfums Inc. produces and distributes a wide array of prestige fragrance and fragrance-related products under license agreements with brand owners. The portfolio of prestige brands includes Abercrombie & Fitch, Anna Sui, Boucheron, Coach, Donna Karan/DKNY, Emanuel Ungaro, Ferragamo, Graff, GUESS, Hollister, Jimmy Choo, Karl Lagerfeld, Kate Spade, Lacoste, MCM, Moncler, Montblanc, Oscar de la Renta, Roberto Cavalli and Van Cleef & Arpels. Inter Parfums Inc. is based in NEW YORK.

Number of Employees: 647 |

|

|

| |

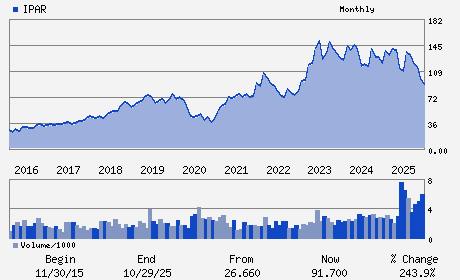

| • Price / Volume Information |

| Yesterday's Closing Price: $100.78 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 233,542 shares |

| Shares Outstanding: 32.06 (millions) |

| Market Capitalization: $3,231.51 (millions) |

| Beta: 1.24 |

| 52 Week High: $146.00 |

| 52 Week Low: $77.21 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.47% |

6.86% |

| 12 Week |

22.71% |

22.32% |

| Year To Date |

18.80% |

21.71% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jean Madar - Chairman and Chief Executive Officer

Philippe Benacin - Vice Chairman of the Board; President and Chief Ex

Michel Atwood - Chief Financial Officer

Philippe Santi - Director and Executive Vice President

Francois Heilbronn - Director

|

|

Peer Information

Interparfums, Inc. (LENXQ)

Interparfums, Inc. (BFXXQ)

Interparfums, Inc. (CENT)

Interparfums, Inc. (FTDL)

Interparfums, Inc. (BTH)

Interparfums, Inc. (JAH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONSM PD-MISC DIS

Sector: Consumer Discretionary

CUSIP: 458334109

SIC: 2844

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 32.06

Most Recent Split Date: 6.00 (1.50:1)

Beta: 1.24

Market Capitalization: $3,231.51 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.18% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.17 |

Indicated Annual Dividend: $3.20 |

| Current Fiscal Year EPS Consensus Estimate: $4.85 |

Payout Ratio: 0.62 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.09 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/15/2025 - $0.80 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |