| Zacks Company Profile for Professional Diversity Network, Inc. (IPDN : NSDQ) |

|

|

| |

| • Company Description |

| Professional Diversity Network LLC develops and operates online networks serving diverse professionals in the United States. The Company is focused on Hispanic-American and African-American professionals and has launched additional Websites to other diverse segments. It offers job postings, resume database access, research services, career advice, advertisement opportunity and newsletter marketing. Professional Diversity Network LLC is based in Chicago, Illinois.

Number of Employees: 43 |

|

|

| |

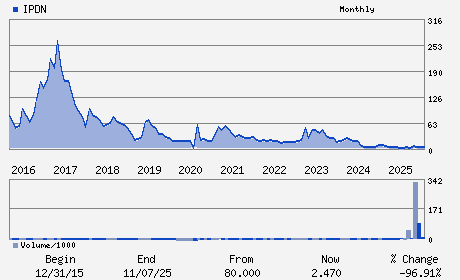

| • Price / Volume Information |

| Yesterday's Closing Price: $1.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 203,085 shares |

| Shares Outstanding: 4.88 (millions) |

| Market Capitalization: $5.86 (millions) |

| Beta: 1.89 |

| 52 Week High: $12.39 |

| 52 Week Low: $0.96 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.11% |

12.57% |

| 12 Week |

-37.82% |

-38.02% |

| Year To Date |

5.26% |

45.15% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Xin Adam He - Chief Executive Officer

Hao Zhang - Chairman

Megan Bozzuto - Chief Financial Officer

Katherine Lauderdale - Director

Ge Yi - Director

|

|

Peer Information

Professional Diversity Network, Inc. (CGEMY)

Professional Diversity Network, Inc. (GLXG)

Professional Diversity Network, Inc. (SRT)

Professional Diversity Network, Inc. (CVG)

Professional Diversity Network, Inc. (HEW)

Professional Diversity Network, Inc. (BBSI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Outsourcing

Sector: Business Services

CUSIP: 74312Y400

SIC: 7370

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/30/26

|

|

Share - Related Items

Shares Outstanding: 4.88

Most Recent Split Date: 3.00 (0.10:1)

Beta: 1.89

Market Capitalization: $5.86 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/30/26 |

|

|

|

| |