| Zacks Company Profile for Inpex Corp. (IPXHY : OTC) |

|

|

| |

| • Company Description |

| Inpex Corporation engages in the research, exploration, development, production, and sale of oil, natural gas, and other mineral resources. The Company also engages in other related businesses and in investment and lending to the companies. It is also engaged in the energy supply business on a global scale. Its operations include acquisition of license blocks for oil and gas fields, exploration, production and the sale of processed products. Inpex Corporation is headquartered in Tokyo, Japan.

Number of Employees: 3,679 |

|

|

| |

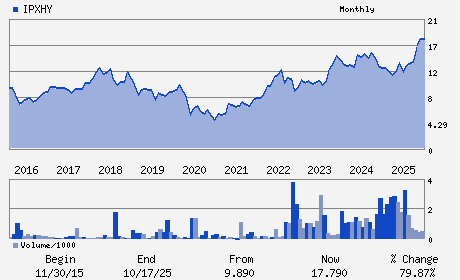

| • Price / Volume Information |

| Yesterday's Closing Price: $24.47 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 44,835 shares |

| Shares Outstanding: 1,186.02 (millions) |

| Market Capitalization: $29,017.14 (millions) |

| Beta: 0.35 |

| 52 Week High: $25.43 |

| 52 Week Low: $11.27 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.17% |

10.13% |

| 12 Week |

19.41% |

19.26% |

| Year To Date |

22.82% |

22.23% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Akasaka Biz Tower 5-3-1 Akasaka Minato-ku

-

Tokyo,M0 107-6332

JPN |

ph: 813-5572-0200

fax: 813-5572-0205 |

None |

http://www.inpex.co.jp |

|

|

| |

| • General Corporate Information |

Officers

Takayuki Ueda - Chief Executive Officer; President and Director

Hiroshi Fujii - Senior Executive Vice President and Director

Hitoshi Okawa - Director

Daisuke Yamada - Director

Jun Yanai - Director

|

|

Peer Information

Inpex Corp. (FXEN)

Inpex Corp. (CLMEF)

Inpex Corp. (BPZRQ)

Inpex Corp. (RDFEY)

Inpex Corp. (EGY)

Inpex Corp. (HBRIY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: International E&P

Sector: Oils/Energy

CUSIP: 45790H101

SIC: 1382

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/12/26

|

|

Share - Related Items

Shares Outstanding: 1,186.02

Most Recent Split Date: 8.00 (4.00:1)

Beta: 0.35

Market Capitalization: $29,017.14 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.93% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.23 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.21 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.09 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/12/26 |

|

|

|

| |