| Zacks Company Profile for John B. Sanfilippo & Son, Inc. (JBSS : NSDQ) |

|

|

| |

| • Company Description |

| John B. Sanfilippo & Son, Inc. is a processor, packager, marketer and distributor of shelled and in-shell nuts and extruded snacks that are sold under a variety of private labels and under the Company's Fisher, Evon's, Snack 'N Serve Nut Bowl, Sunshine Country, Flavor Tree and Texas Pride brand names. The Company also markets and distributes a diverse product line of other food and snack items.

Number of Employees: 1,900 |

|

|

| |

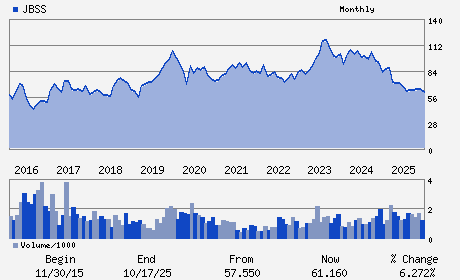

| • Price / Volume Information |

| Yesterday's Closing Price: $82.61 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 67,142 shares |

| Shares Outstanding: 11.69 (millions) |

| Market Capitalization: $965.45 (millions) |

| Beta: 0.35 |

| 52 Week High: $85.15 |

| 52 Week Low: $58.47 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.11% |

3.01% |

| 12 Week |

14.61% |

14.47% |

| Year To Date |

17.01% |

16.44% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jeffrey T. Sanfilippo - Chief Executive Officer and Director

Frank S. Pellegrino - Chief Financial Office and Executive Vice Presiden

Michael J. Finn - Vice President and Corporate Controller

Pamela Forbes Lieberman - Director

Mercedes Romero - Director

|

|

Peer Information

John B. Sanfilippo & Son, Inc. (CDSCY)

John B. Sanfilippo & Son, Inc. (HDNHY)

John B. Sanfilippo & Son, Inc. (CPB)

John B. Sanfilippo & Son, Inc. (AMNF)

John B. Sanfilippo & Son, Inc. (GMFIY)

John B. Sanfilippo & Son, Inc. (BRID)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FOOD-MISC/DIVERSIFIED

Sector: Consumer Staples

CUSIP: 800422107

SIC: 2060

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 11.69

Most Recent Split Date: (:1)

Beta: 0.35

Market Capitalization: $965.45 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.09% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.16 |

Indicated Annual Dividend: $0.90 |

| Current Fiscal Year EPS Consensus Estimate: $5.57 |

Payout Ratio: 0.15 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/01/2025 - $1.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |