| Zacks Company Profile for Jiangsu Expressway Co. (JEXYY : OTC) |

|

|

| |

| • Company Description |

| Jiangsu Expressway Company Limited engages in the investment, construction, operation, and management of toll roads and bridges. The company offers passenger transport and other services like refueling, catering, retailing, automobile repair and maintenance, advertising, and accommodation. In addition, it involves in the investment, development, and consulting of real estate properties. Jiangsu Expressway Company Limited is headquartered in Nanjing, the People's Republic of China.

Number of Employees: |

|

|

| |

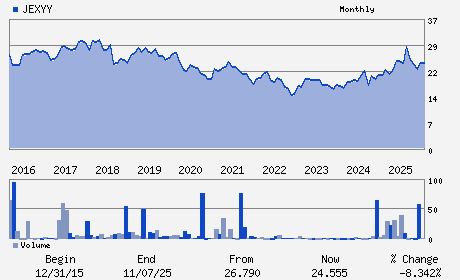

| • Price / Volume Information |

| Yesterday's Closing Price: $25.70 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3 shares |

| Shares Outstanding: (millions) |

| Market Capitalization: $ (millions) |

| Beta: 0.15 |

| 52 Week High: $29.00 |

| 52 Week Low: $21.71 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.00% |

0.87% |

| 12 Week |

-0.16% |

-0.28% |

| Year To Date |

-0.39% |

-0.87% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

De Jun Gu - Chairman

Zhou Hua Ren - Chief Financial Officer

Xibin Sun - General Manager and Director

Jie Li - Director

Yong Jia Yao - Director

|

|

Peer Information

- (-)

- (-)

- (-)

- (-)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-HEAVY CNST

Sector: Construction

CUSIP: 477373104

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding:

Most Recent Split Date: (:1)

Beta: 0.15

Market Capitalization: $ (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.70% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.21 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |