| Zacks Company Profile for Johnson & Johnson (JNJ : NYSE) |

|

|

| |

| • Company Description |

| Johnson & Johnson's biggest strength is its diversified business model. It operates through pharmaceuticals, medical devices and consumer products divisions. Its diversification helps it to withstand economic cycles more effectively. J&J has one of the largest research and development (R&D) budget among pharma companies. J&J's worldwide business is divided into three segments: Pharmaceutical, Medical Devices and Consumer. The company has several drugs covering a broad range of areas such as neuroscience, cardiovascular & metabolism, immunology, oncology, pulmonary hypertension and infectious diseases and vaccines. The Medical Devices Segment offers products in the orthopedics, surgery, interventional solutions and vision markets. The Consumer Segment segment includes a broad range of products covering the areas of baby care, beauty/skin health, oral care, wound care and womens' health care, as well as over-the-counter (OTC) pharmaceutical products.

Number of Employees: 138,200 |

|

|

| |

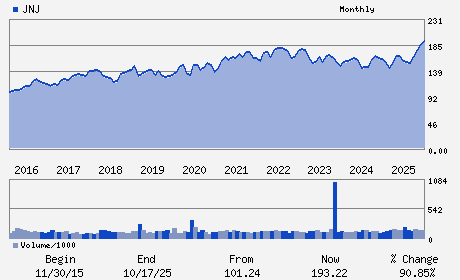

| • Price / Volume Information |

| Yesterday's Closing Price: $248.43 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 9,063,322 shares |

| Shares Outstanding: 2,409.90 (millions) |

| Market Capitalization: $598,691.19 (millions) |

| Beta: 0.34 |

| 52 Week High: $248.94 |

| 52 Week Low: $141.50 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.32% |

10.28% |

| 12 Week |

23.03% |

22.88% |

| Year To Date |

20.04% |

19.46% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

J. Duato - Chief Executive Officer;Chairman of the Board

J. J. Wolk - Chief Financial Officer

R. J. Decker Jr. - Controller and Chief Accounting Officer

M. C. Beckerle - Director

J. A. Doudna - Director

|

|

Peer Information

Johnson & Johnson (AGN.)

Johnson & Johnson (NVS)

Johnson & Johnson (NVO)

Johnson & Johnson (LLY)

Johnson & Johnson (RHHBY)

Johnson & Johnson (JNJ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Large Cap Pharma

Sector: Medical

CUSIP: 478160104

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/21/26

|

|

Share - Related Items

Shares Outstanding: 2,409.90

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.34

Market Capitalization: $598,691.19 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.09% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.68 |

Indicated Annual Dividend: $5.20 |

| Current Fiscal Year EPS Consensus Estimate: $11.54 |

Payout Ratio: 0.48 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 8.93% |

Last Dividend Paid: 02/24/2026 - $1.30 |

| Next EPS Report Date: 04/21/26 |

|

|

|

| |