| Zacks Company Profile for Kaiser Aluminum Corporation (KALU : NSDQ) |

|

|

| |

| • Company Description |

| Kaiser Aluminum is a leading producer of semi-fabricated specialty aluminum products, serving customers worldwide with highly-engineered solutions for aerospace and high-strength, general engineering, and custom automotive and industrial applications. The Company's North American facilities produce value-added sheet, plate, extrusions, rod, bar, tube, and wire products, adhering to traditions of quality, innovation, and service. Kaiser Aluminum is headquartered in Foothill Ranch, California.

Number of Employees: 3,840 |

|

|

| |

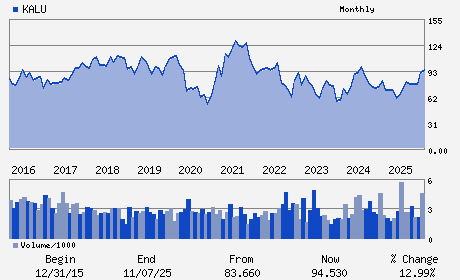

| • Price / Volume Information |

| Yesterday's Closing Price: $130.14 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 247,320 shares |

| Shares Outstanding: 16.21 (millions) |

| Market Capitalization: $2,109.63 (millions) |

| Beta: 1.37 |

| 52 Week High: $150.00 |

| 52 Week Low: $46.81 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.13% |

7.06% |

| 12 Week |

24.40% |

24.25% |

| Year To Date |

13.30% |

12.75% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Keith A. Harvey - Chairman; President and Chief Executive Officer

Neal E. West - Executive Vice President and Chief Financial Offic

Vijai Narayan - Vice President and Chief Accounting Officer

Michael C. Arnold - Director

David A. Foster - Director

|

|

Peer Information

Kaiser Aluminum Corporation (DCS.)

Kaiser Aluminum Corporation (CPTD)

Kaiser Aluminum Corporation (HIHO)

Kaiser Aluminum Corporation (T.GNA)

Kaiser Aluminum Corporation (HTLJ)

Kaiser Aluminum Corporation (CENX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: METAL PROC&FABR

Sector: Industrial Products

CUSIP: 483007704

SIC: 3350

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 16.21

Most Recent Split Date: (:1)

Beta: 1.37

Market Capitalization: $2,109.63 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.37% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.69 |

Indicated Annual Dividend: $3.08 |

| Current Fiscal Year EPS Consensus Estimate: $7.33 |

Payout Ratio: 0.51 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -2.16 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/23/2026 - $0.77 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |