| Zacks Company Profile for Kuehne & Nagel International Ag (KHNGY : OTC) |

|

|

| |

| • Company Description |

| Kuehne + Nagel International AG is a logistics company. It operates through six segments: Seafreight, Airfreight, Road & Rail Logistics, Contract Logistics, Real Estate, and Insurance Brokers. The Company is engaged in transportation services, including carrier services and contracts of carriage related to shipment; provision of services related to warehouse and distribution activities; brokerage services of insurance coverage, mainly marine liability; and covers activities mainly related to internal rent of facilities. It operates in Europe, the Americas, the Asia-Pacific, the Middle East, Central Asia, and Africa. Kuehne + Nagel International AG is headquartered in Schindellegi, Switzerland.

Number of Employees: 75,241 |

|

|

| |

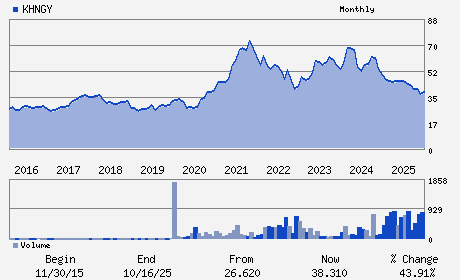

| • Price / Volume Information |

| Yesterday's Closing Price: $46.52 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 9,192 shares |

| Shares Outstanding: 603.77 (millions) |

| Market Capitalization: $28,087.33 (millions) |

| Beta: 0.87 |

| 52 Week High: $49.66 |

| 52 Week Low: $36.76 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.67% |

1.55% |

| 12 Week |

14.33% |

14.19% |

| Year To Date |

6.76% |

6.24% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Stefan Paul - Chief Executive Officer

Markus Blanka-Graff - Chief Financial Officer

Martin Kolbe - Chief Information Officer

Gianfranco Sgro - Executive VP of Contract Logistics & Member of Man

Yngve Ruud - Executive VP of Air Logistics & Member of the Mana

|

|

Peer Information

Kuehne & Nagel International Ag (HKAEY)

Kuehne & Nagel International Ag (UHAL)

Kuehne & Nagel International Ag (LYNG)

Kuehne & Nagel International Ag (MATX)

Kuehne & Nagel International Ag (GLC)

Kuehne & Nagel International Ag (FAVS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-SERVICES

Sector: Transportation

CUSIP: 501187108

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/02/26

|

|

Share - Related Items

Shares Outstanding: 603.77

Most Recent Split Date: (:1)

Beta: 0.87

Market Capitalization: $28,087.33 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.66% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.36 |

Indicated Annual Dividend: $1.24 |

| Current Fiscal Year EPS Consensus Estimate: $1.85 |

Payout Ratio: 0.62 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.19 |

| Estmated Long-Term EPS Growth Rate: 18.29% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/02/26 |

|

|

|

| |