| Zacks Company Profile for KLA Corporation (KLAC : NSDQ) |

|

|

| |

| • Company Description |

| KLA Corporation is an original equipment manufacturer (OEM) of process diagnostics and control (PDC) equipment and yield management solutions required for the fabrication of semiconductor integrated circuits (ICs) or chips. The company has a comprehensive portfolio of products addressing each major PDC subsegment'photomask (reticle) inspection, wafer inspection/defect review and metrology.Reticle production is vital to the semiconductor device formation process. Reticles are used to control the precise deposition of materials onto the wafer, which ultimately change its chemical characteristics, imparting specific functionalities to the ICs thus created. Inspection and metrology tools measure the quality of the reticles, helping to improve reticle production yields. As a result of the broader applicability of semiconductors, shrinking form factors and increasing functionalities of individual chips, reticle design and production are growing in importance.

Number of Employees: 15,200 |

|

|

| |

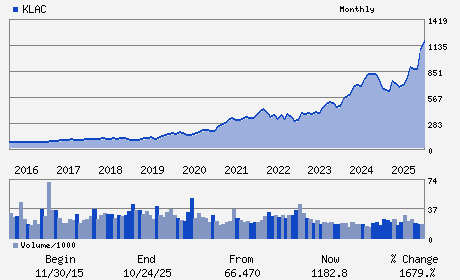

| • Price / Volume Information |

| Yesterday's Closing Price: $1,524.55 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,051,322 shares |

| Shares Outstanding: 131.08 (millions) |

| Market Capitalization: $199,832.86 (millions) |

| Beta: 1.45 |

| 52 Week High: $1,693.35 |

| 52 Week Low: $551.33 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.77% |

7.70% |

| 12 Week |

25.53% |

25.38% |

| Year To Date |

25.47% |

24.86% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

ONE TECHNOLOGY DRIVE

-

MILPITAS,CA 95035

USA |

ph: 408-875-3000

fax: 408-875-4144 |

kevin.kessel@kla.com |

http://www.kla.com |

|

|

| |

| • General Corporate Information |

Officers

Richard P. Wallace - Chief Executive Officer and President

Robert M. Calderoni - Chairman

Bren D. Higgins - Executive Vice President and Chief Financial Offic

Virendra A. Kirloskar - Senior Vice President

Jeneanne Hanley - Director

|

|

Peer Information

KLA Corporation (REFR)

KLA Corporation (BELFA)

KLA Corporation (DIPC)

KLA Corporation (V.SSC)

KLA Corporation (BNSOF)

KLA Corporation (CUB.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC PRODS-MISC

Sector: Computer and Technology

CUSIP: 482480100

SIC: 3827

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 131.08

Most Recent Split Date: 1.00 (2.00:1)

Beta: 1.45

Market Capitalization: $199,832.86 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.50% |

| Current Fiscal Quarter EPS Consensus Estimate: $9.12 |

Indicated Annual Dividend: $7.60 |

| Current Fiscal Year EPS Consensus Estimate: $36.58 |

Payout Ratio: 0.21 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 13.54% |

Last Dividend Paid: 02/17/2026 - $1.90 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |