| Zacks Company Profile for Kontoor Brands, Inc. (KTB : NYSE) |

|

|

| |

| • Company Description |

| Kontoor Brands Inc. is an apparel company. It designs, manufactures and distributes products. The company's brand consists of Wrangler(R), Lee(R) and Rock & Republic(R). Kontoor Brands Inc. is based in Greensboro, United States.

Number of Employees: 13,200 |

|

|

| |

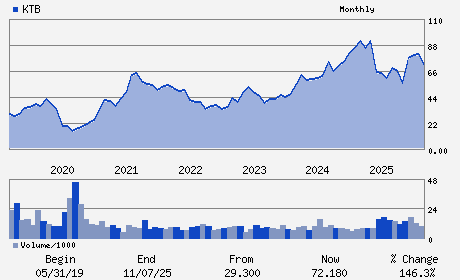

| • Price / Volume Information |

| Yesterday's Closing Price: $65.21 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 741,495 shares |

| Shares Outstanding: 55.59 (millions) |

| Market Capitalization: $3,625.26 (millions) |

| Beta: 1.15 |

| 52 Week High: $87.00 |

| 52 Week Low: $50.80 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.17% |

10.13% |

| 12 Week |

-14.42% |

-14.53% |

| Year To Date |

6.74% |

6.23% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Scott H. Baxter - Chief Executive Officer; Chairman of the Board of

Joseph A. Alkire - Executive Vice President and Chief Financial Offic

S. Denise Sumner - Vice President and Chief Accounting Officer

Robert K. Shearer - Director

Maryelizabeth R. Campbell - Director

|

|

Peer Information

Kontoor Brands, Inc. (DLWI)

Kontoor Brands, Inc. (DNKYQ)

Kontoor Brands, Inc. (CYDS)

Kontoor Brands, Inc. (GOSHA)

Kontoor Brands, Inc. (JLMCQ)

Kontoor Brands, Inc. (FUNW)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TEXTILE-APPAREL

Sector: Consumer Discretionary

CUSIP: 50050N103

SIC: 2320

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/03/26

|

|

Share - Related Items

Shares Outstanding: 55.59

Most Recent Split Date: (:1)

Beta: 1.15

Market Capitalization: $3,625.26 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.25% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $2.12 |

| Current Fiscal Year EPS Consensus Estimate: $5.79 |

Payout Ratio: 0.40 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/08/2025 - $0.53 |

| Next EPS Report Date: 03/03/26 |

|

|

|

| |