| Zacks Company Profile for LGI Homes, Inc. (LGIH : NSDQ) |

|

|

| |

| • Company Description |

| LGI Homes, Inc. is engaged in the design and construction of entry-level homes across Texas, Arizona, Florida and Georgia. The company focuses on converting renters of apartments and single-family homes into homeowners by offering homes at affordable locations. LGI Homes, Inc. is headquartered in The Woodlands, Texas.

Number of Employees: 1,056 |

|

|

| |

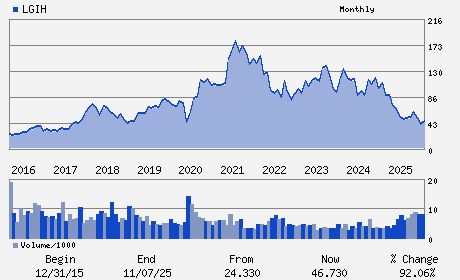

| • Price / Volume Information |

| Yesterday's Closing Price: $51.90 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 378,349 shares |

| Shares Outstanding: 23.13 (millions) |

| Market Capitalization: $1,200.61 (millions) |

| Beta: 1.88 |

| 52 Week High: $77.38 |

| 52 Week Low: $39.70 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.57% |

4.48% |

| 12 Week |

2.98% |

2.85% |

| Year To Date |

20.81% |

20.22% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Eric Lipar - Chief Executive Officer and Chairman of the Board

Charles Merdian - Chief Financial Officer and Treasurer

Ryan Edone - Director

Shailee Parikh - Director

Bryan Sansbury - Director

|

|

Peer Information

LGI Homes, Inc. (CLPO)

LGI Homes, Inc. (IAHM)

LGI Homes, Inc. (HLCO)

LGI Homes, Inc. (ENGEF)

LGI Homes, Inc. (BZH)

LGI Homes, Inc. (CSHHY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-RSDNT/COMR

Sector: Construction

CUSIP: 50187T106

SIC: 1531

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 23.13

Most Recent Split Date: (:1)

Beta: 1.88

Market Capitalization: $1,200.61 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.19 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.45 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |