| Zacks Company Profile for Cheniere Energy, Inc. (LNG : NYSE) |

|

|

| |

| • Company Description |

| Cheniere Energy Inc. is primarily engaged in businesses related to liquefied natural gas (or LNG) through its two business segments: LNG terminal; and LNG and natural gas marketing. The company, through its controlling interest in Cheniere Energy Partners L.P., owns and operates the Sabine Pass LNG terminal in Louisiana - North America's first large-scale liquefied gas export facility. Furthermore, Cheniere Energy owns and operates the 94-mile Creole Trail Pipeline - an interconnect between the Sabine Pass receiving terminal and the downstream markets - through its subsidiary.

Number of Employees: 1,717 |

|

|

| |

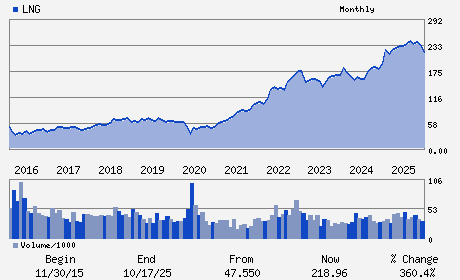

| • Price / Volume Information |

| Yesterday's Closing Price: $235.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,785,664 shares |

| Shares Outstanding: 210.20 (millions) |

| Market Capitalization: $49,551.12 (millions) |

| Beta: 0.25 |

| 52 Week High: $246.42 |

| 52 Week Low: $186.20 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.45% |

12.42% |

| 12 Week |

14.60% |

14.46% |

| Year To Date |

21.27% |

20.68% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jack A. Fusco - President and Chief Executive Officer

G. Andrea Botta - Chairman of the Board

Zach Davis - Executive Vice President and Chief Financial Offic

David Slack - Senior Vice President and Chief Accounting Officer

Denise Gray - Director

|

|

Peer Information

Cheniere Energy, Inc. (AEGG)

Cheniere Energy, Inc. (CHAR)

Cheniere Energy, Inc. (CECX.)

Cheniere Energy, Inc. (DLOV)

Cheniere Energy, Inc. (WACC)

Cheniere Energy, Inc. (DVN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-US EXP&PROD

Sector: Oils/Energy

CUSIP: 16411R208

SIC: 4924

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 210.20

Most Recent Split Date: 4.00 (2.00:1)

Beta: 0.25

Market Capitalization: $49,551.12 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.94% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.71 |

Indicated Annual Dividend: $2.22 |

| Current Fiscal Year EPS Consensus Estimate: $13.34 |

Payout Ratio: 0.13 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/06/2026 - $0.56 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |