| Zacks Company Profile for Light & Wonder, Inc. (LNWO : OTC) |

|

|

| |

| • Company Description |

| Light & Wonder Inc. is a cross-platform games and entertainment company. Its OpenGaming(TM) platform powers digital-gaming network in the industry. Light & Wonder Inc., formerly known as Scientific Games Corporation, is based in LAS VEGAS.

Number of Employees: 6,800 |

|

|

| |

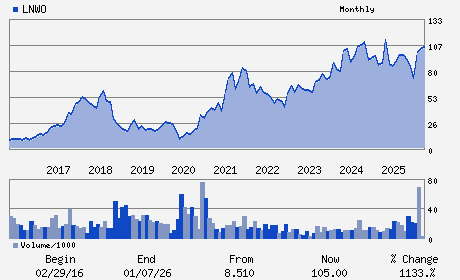

| • Price / Volume Information |

| Yesterday's Closing Price: $93.94 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 96,805 shares |

| Shares Outstanding: 81.52 (millions) |

| Market Capitalization: $7,658.35 (millions) |

| Beta: 1.36 |

| 52 Week High: $122.65 |

| 52 Week Low: $69.56 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-19.02% |

-18.31% |

| 12 Week |

-3.99% |

-4.10% |

| Year To Date |

-8.88% |

-9.32% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

6601 BERMUDA ROAD

-

LAS VEGAS,NV 89119

USA |

ph: 702-897-7150

fax: 702-897-2284 |

ir@lnw.com |

http://www.lnw.com |

|

|

| |

| • General Corporate Information |

Officers

Matthew R. Wilson - President and Chief Executive Officer

Jamie R. Odell - Chair of the Board of Directors

Antonia Korsanos - Vice Chair of the Board of Directors

Oliver Chow - Executive Vice President; Chief Financial Officer

Vanja Kalabic - Senior Vice President and Chief Accounting Officer

|

|

Peer Information

Light & Wonder, Inc. (CHLD.)

Light & Wonder, Inc. (FGRD)

Light & Wonder, Inc. (CGMI.)

Light & Wonder, Inc. (AGAM.)

Light & Wonder, Inc. (ASCA.)

Light & Wonder, Inc. (BYD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: GAMING

Sector: Consumer Discretionary

CUSIP: 80874P109

SIC: 7373

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 81.52

Most Recent Split Date: 10.00 (2.00:1)

Beta: 1.36

Market Capitalization: $7,658.35 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.63 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $7.30 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |