| Zacks Company Profile for Marriott International, Inc. (MAR : NSDQ) |

|

|

| |

| • Company Description |

| Marriott International Inc. is a worldwide operator, franchisor, and licensor of hotel, residential, and timeshare properties under numerous brand names at different price and service points. They have two operating segments: U.S. & Canada and International. Marriott operates and franchises hotels and licenses vacation ownership resorts all around the world.

Number of Employees: 414,000 |

|

|

| |

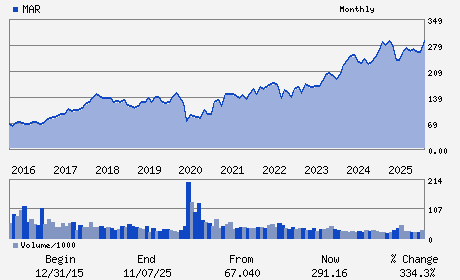

| • Price / Volume Information |

| Yesterday's Closing Price: $341.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,810,377 shares |

| Shares Outstanding: 264.98 (millions) |

| Market Capitalization: $90,553.18 (millions) |

| Beta: 1.09 |

| 52 Week High: $370.00 |

| 52 Week Low: $205.40 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.38% |

9.33% |

| 12 Week |

16.80% |

16.65% |

| Year To Date |

10.15% |

9.62% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Anthony G. Capuano - President; Chief Executive Officer and Director

David S. Marriott - Chairman of the Board

Kathleen K. Oberg - Chief Financial Officer and Executive Vice Preside

Aylwin B. Lewis - Director

Isabella D. Goren - Director

|

|

Peer Information

Marriott International, Inc. (HOT.)

Marriott International, Inc. (CHH)

Marriott International, Inc. (ESA.)

Marriott International, Inc. (GPSRY)

Marriott International, Inc. (FS)

Marriott International, Inc. (CLMDY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: HOTELS & MOTELS

Sector: Consumer Discretionary

CUSIP: 571903202

SIC: 7011

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 264.98

Most Recent Split Date: 11.00 (1.00:1)

Beta: 1.09

Market Capitalization: $90,553.18 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.78% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.57 |

Indicated Annual Dividend: $2.68 |

| Current Fiscal Year EPS Consensus Estimate: $11.59 |

Payout Ratio: 0.27 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: 0.08 |

| Estmated Long-Term EPS Growth Rate: 9.77% |

Last Dividend Paid: 02/26/2026 - $0.67 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |