| Zacks Company Profile for Mativ Holdings, Inc. (MATV : NYSE) |

|

|

| |

| • Company Description |

| Mativ Holdings Inc. is a specialty materials company. It offers a wide range of critical components and engineered solutions. The company's operating segments include Advanced Technical Materials and Fiber-Based Solutions. Advanced Technical Materials business unit includes Filtration, Protective Solutions, Release Liners, Healthcare and Industrials. Fiber-Based Solutions segment includes Engineered Papers and Packaging and Specialty Paper. Mativ Holdings Inc., formerly known as Schweitzer-Mauduit International Inc., is headquartered in Alpharetta, Georgia.

Number of Employees: 5,100 |

|

|

| |

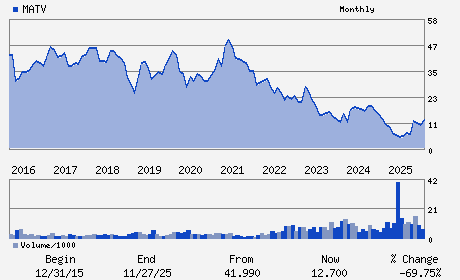

| • Price / Volume Information |

| Yesterday's Closing Price: $11.06 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 369,377 shares |

| Shares Outstanding: 54.68 (millions) |

| Market Capitalization: $604.77 (millions) |

| Beta: 0.82 |

| 52 Week High: $15.48 |

| 52 Week Low: $4.34 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-10.08% |

-9.30% |

| 12 Week |

-8.90% |

-9.58% |

| Year To Date |

-8.97% |

-9.81% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

100 KIMBALL PL SUITE 600

-

ALPHARETTA,GA 30009

USA |

ph: 1-770-569-4229

fax: 770-569-4275 |

investors@mativ.com |

http://www.mativ.com |

|

|

| |

| • General Corporate Information |

Officers

Julie Schertell - President; Chief Executive Officer; and Director

Greg Weitzel - Executive Vice President and Chief Financial Offic

Cheryl Allegri - Corporate Controller and Chief Accounting Officer

William Cook - Director

Shruti Singhal - Director

|

|

Peer Information

Mativ Holdings, Inc. (CSBHY)

Mativ Holdings, Inc. (ARWM)

Mativ Holdings, Inc. (FUL)

Mativ Holdings, Inc. (IAX)

Mativ Holdings, Inc. (AVD)

Mativ Holdings, Inc. (ASH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-SPECIALTY

Sector: Basic Materials

CUSIP: 808541106

SIC: 2621

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 54.68

Most Recent Split Date: 8.00 (2.00:1)

Beta: 0.82

Market Capitalization: $604.77 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.62% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.02 |

Indicated Annual Dividend: $0.40 |

| Current Fiscal Year EPS Consensus Estimate: $0.85 |

Payout Ratio: 0.55 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 11/28/2025 - $0.10 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |