| Zacks Company Profile for MBIA, Inc. (MBI : NYSE) |

|

|

| |

| • Company Description |

| MBIA Incorporated is engaged in providing financial guaranteeinsurance and investment management and financial services to public finance clients and financial institutions on a global basis. Financial guarantees for municipal bonds, asset-backed and mortgage-backed securities, investor-owned utility bonds, and collateralized obligations of sovereigns, corporations and financial institutions, both in the new issue and secondary markets, are provided through the Company's wholly-owned subsidiary, MBIA Insurance Corporation.

Number of Employees: 57 |

|

|

| |

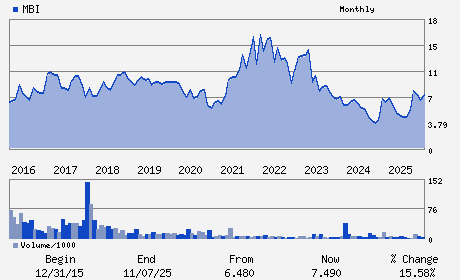

| • Price / Volume Information |

| Yesterday's Closing Price: $6.55 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 350,892 shares |

| Shares Outstanding: 50.51 (millions) |

| Market Capitalization: $330.85 (millions) |

| Beta: 1.87 |

| 52 Week High: $8.26 |

| 52 Week Low: $3.86 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.34% |

3.24% |

| 12 Week |

-11.01% |

-11.11% |

| Year To Date |

-8.52% |

-8.96% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1 MANHATTANVILLE ROAD SUITE 301

-

PURCHASE,NY 10577

USA |

ph: 914-273-4545

fax: 914-765-3177 |

greg.diamond@mbia.com |

http://www.mbia.com |

|

|

| |

| • General Corporate Information |

Officers

William C. Fallon - Chief Executive Officer and Director

Steven J. Gilbert - Chairman and Director

Joseph R. Schachinger - Chief Financial Officer

Shengying Yu - Assistant Vice President and Controller

Diane Dewbrey - Director

|

|

Peer Information

MBIA, Inc. (RDN)

MBIA, Inc. (AIG)

MBIA, Inc. (ACGI)

MBIA, Inc. (TXSC)

MBIA, Inc. (PTVCB)

MBIA, Inc. (PTVCA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-MULTI LINE

Sector: Finance

CUSIP: 55262C100

SIC: 6351

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 50.51

Most Recent Split Date: 4.00 (1.50:1)

Beta: 1.87

Market Capitalization: $330.85 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.11 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.27 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |