| Zacks Company Profile for MFA Financial, Inc. (MFA : NYSE) |

|

|

| |

| • Company Description |

| MFA Mortgage Investments, Inc. operates as a real estate investment trust primarily engaged in the business of investing in mortgage-backed securities. The company also has indirect investment in Lealand Place, a multifamily apartment property located in Lawrenceville, Georgia. In addition, it provides investment advisory services to a third-party institution with respect to their MBS portfolio investments.

Number of Employees: 307 |

|

|

| |

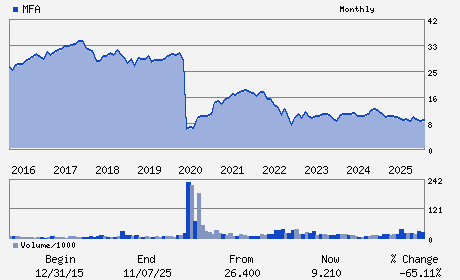

| • Price / Volume Information |

| Yesterday's Closing Price: $10.11 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,292,264 shares |

| Shares Outstanding: 102.09 (millions) |

| Market Capitalization: $1,032.17 (millions) |

| Beta: 1.57 |

| 52 Week High: $11.08 |

| 52 Week Low: $7.85 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.88% |

5.79% |

| 12 Week |

5.20% |

5.07% |

| Year To Date |

8.59% |

8.07% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Craig L. Knutson - Chief Executive Officer and Director

Laurie Goodman - Chairman and Director

Michael Roper - Senior Vice President and Chief Financial Officer

Bryan Doran - Senior Vice President and Chief Accounting Officer

Robin Josephs - Director

|

|

Peer Information

MFA Financial, Inc. (CHAS.)

MFA Financial, Inc. (DVLN)

MFA Financial, Inc. (ACPIQ)

MFA Financial, Inc. (MITT)

MFA Financial, Inc. (AAIC)

MFA Financial, Inc. (WAC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-MTGE TRUST

Sector: Finance

CUSIP: 55272X607

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 102.09

Most Recent Split Date: 4.00 (0.25:1)

Beta: 1.57

Market Capitalization: $1,032.17 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 14.24% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.44 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 1.66 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.40 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/31/2025 - $0.36 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |