| Zacks Company Profile for Manulife Financial Corp (MFC : NYSE) |

|

|

| |

| • Company Description |

| Manulife Financial Corporation one of the dominant life insurers. Manulife reports earnings through six divisions and has five major operating divisions - Asia, Canada, U.S. Insurance and U.S. Wealth Management and Corporate. The Global Wealth and Asset Management offers a broad range of personal and family-oriented wealth management products and services focused on individuals and business markets. The segment has three core business lines - John Hancock Wealth Asset Management, John Hancock Variable Annuities and John Hancock Fixed Products. Corporate and Other is comprised of the earnings on assets backing capital. The Canadian division offers a diverse portfolio of products, services and distribution channels. The segment also markets life, health and specialty products, such as travel insurance, to consumers through a number of alternative distribution channels. Through Manulife Bank, the segment offers a variety of lending products including fixed and variable rate mortgages.

Number of Employees: 37,000 |

|

|

| |

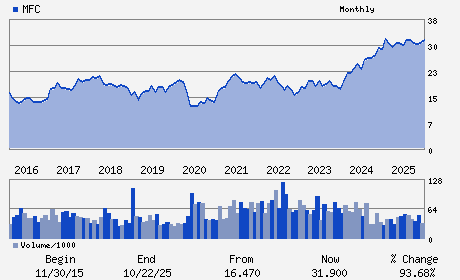

| • Price / Volume Information |

| Yesterday's Closing Price: $35.54 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,208,362 shares |

| Shares Outstanding: 1,676.75 (millions) |

| Market Capitalization: $59,591.73 (millions) |

| Beta: 0.83 |

| 52 Week High: $38.72 |

| 52 Week Low: $25.92 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.81% |

-6.60% |

| 12 Week |

0.79% |

0.48% |

| Year To Date |

-2.04% |

-2.17% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Phil Witherington - Chief Executive Officer and President

Don Lindsay - Chairman of the Board of Directors

Rahul Joshi - Chief Operations Officer

Colin Simpson - Chief Financial Officer

Pragashini Fox - Chief People Officer

|

|

Peer Information

Manulife Financial Corp (AGC.)

Manulife Financial Corp (T.GWO)

Manulife Financial Corp (AMH.2)

Manulife Financial Corp (CSLI.)

Manulife Financial Corp (CIA)

Manulife Financial Corp (DFG)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-LIFE

Sector: Finance

CUSIP: 56501R106

SIC: 6311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 1,676.75

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.83

Market Capitalization: $59,591.73 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.98% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.80 |

Indicated Annual Dividend: $1.41 |

| Current Fiscal Year EPS Consensus Estimate: $3.28 |

Payout Ratio: 0.41 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 11/26/2025 - $0.31 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |