| Zacks Company Profile for Altria Group, Inc. (MO : NYSE) |

|

|

| |

| • Company Description |

| Altria has a leading portfolio of tobacco products for U.S. tobacco consumers age 21 . Altria's wholly owned subsidiaries include leading manufacturers of both combustible and smoke-free products. In combustibles, Altria owns Philip Morris USA Inc. (PM USA), the most profitable U.S. cigarette manufacturer, and John Middleton Co. (Middleton), a leading U.S. cigar manufacturer. Altria's smoke-free portfolio includes ownership of U.S. Smokeless Tobacco Company LLC (USSTC), the leading global moist smokeless tobacco (MST) manufacturer, and Helix Innovations LLC (Helix), a rapidly growing manufacturer of oral nicotine pouches. Altria also owns equity investments in Anheuser-Busch InBev SA/NV (ABI), the world's largest brewer, and Cronos Group Inc. (Cronos), a leading Canadian cannabinoid company.

Number of Employees: 5,900 |

|

|

| |

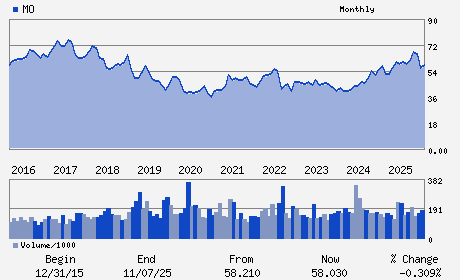

| • Price / Volume Information |

| Yesterday's Closing Price: $69.04 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,792,156 shares |

| Shares Outstanding: 1,671.90 (millions) |

| Market Capitalization: $115,427.84 (millions) |

| Beta: 0.45 |

| 52 Week High: $70.51 |

| 52 Week Low: $52.82 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.37% |

12.35% |

| 12 Week |

19.06% |

18.91% |

| Year To Date |

19.74% |

19.16% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

6601 WEST BROAD STREET

-

RICHMOND,VA 23230

USA |

ph: 804-274-2200

fax: 804-484-8231 |

None |

http://www.altria.com |

|

|

| |

| • General Corporate Information |

Officers

William F. Gifford, Jr - Chief Executive Officer

Salvatore Mancuso - Vice President and Chief Financial Officer

Katie F. Patterson - Vice President and Controller

Marjorie M. Connelly - Director

R. Matt Davis - Director

|

|

Peer Information

Altria Group, Inc. (SOZCF)

Altria Group, Inc. (ISPR)

Altria Group, Inc. (CIGR)

Altria Group, Inc. (STW.)

Altria Group, Inc. (SWMA.)

Altria Group, Inc. (UST.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TOBACCO

Sector: Consumer Staples

CUSIP: 02209S103

SIC: 2111

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 1,671.90

Most Recent Split Date: 4.00 (3.00:1)

Beta: 0.45

Market Capitalization: $115,427.84 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 6.14% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.24 |

Indicated Annual Dividend: $4.24 |

| Current Fiscal Year EPS Consensus Estimate: $5.60 |

Payout Ratio: 0.78 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 4.15% |

Last Dividend Paid: 12/26/2025 - $1.06 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |