| Zacks Company Profile for MPLX LP (MPLX : NYSE) |

|

|

| |

| • Company Description |

| MPLX LP is a master limited partnership engaged in providing a wide range of midstream energy services, including fuel distribution solutions. The large-cap partnership owns, operate and develop midstream energy infrastructures and logistics assets, mostly for its parent company Marathon Petroleum Corporation. Apart from oil and natural gas gathering systems, the partnership's midstream assets comprise transportation pipelines for crude, natural gas and refined petroleum products. MPLX also has processing and fractionation facilities for natural gas and natural gas liquids. MPLX divides its operations into two segments - Logistics and Storage and Gathering and Processing. L&S:?The partnership's logistics and storage properties, which were primarily dropped down from Marathon Petroleum. G&P:?MPLX's gathering and processing properties are located in regions of the United States.

Number of Employees: 5,560 |

|

|

| |

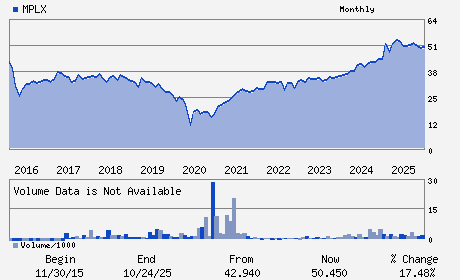

| • Price / Volume Information |

| Yesterday's Closing Price: $58.66 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,050,813 shares |

| Shares Outstanding: 1,017.07 (millions) |

| Market Capitalization: $59,661.04 (millions) |

| Beta: 0.57 |

| 52 Week High: $59.44 |

| 52 Week Low: $44.60 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.30% |

5.21% |

| 12 Week |

4.97% |

4.19% |

| Year To Date |

9.91% |

8.90% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Maryann T. Mannen - Chief Executive Officer; President and Director

Michael J. Hennigan - Executive Chairman of the Board of Directors

Gregory S. Floerke - Executive Vice President and Chief Operating Offic

C. Kristopher Hagedorn - Executive Vice President and Chief Financial Offic

Molly R. Benson - Chief Legal Officer and Corporate Secretary

|

|

Peer Information

MPLX LP (ENCC.)

MPLX LP (ENGT)

MPLX LP (M.PNG)

MPLX LP (POCC)

MPLX LP (KPP)

MPLX LP (MWP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-PROD/PIPELN

Sector: Oils/Energy

CUSIP: 55336V100

SIC: 4610

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 1,017.07

Most Recent Split Date: (:1)

Beta: 0.57

Market Capitalization: $59,661.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 7.34% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.08 |

Indicated Annual Dividend: $4.31 |

| Current Fiscal Year EPS Consensus Estimate: $4.51 |

Payout Ratio: 0.89 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 2.47% |

Last Dividend Paid: 02/09/2026 - $1.08 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |