| Zacks Company Profile for Morgan Stanley (MS : NYSE) |

|

|

| |

| • Company Description |

| Morgan Stanley, being the leading financial services holding company, serves corporations, governments, FIs & individuals world wide. It has 3 business units. The Institutional Securities unit includes capital raising, financial advisory services on mergers & acquisitions, restructurings, real estate & project finance, corporate lending, sales, trading, financing & market-making activities in equity & fixed income securities & related products. The Wealth Management unit provides brokerage & investment advisory services on various investment alternatives, financial & wealth planning services, annuity & other insurance products, credit & other lending products, cash management & retirement services and trust & fiduciary services and engages in fixed income principal trading. The Investment Management unit provides global asset management products & services in equity, fixed income, alternative investments in hedge funds & funds of funds and merchant banking i.e. real estate, private equity & infrastructure.

Number of Employees: 82,992 |

|

|

| |

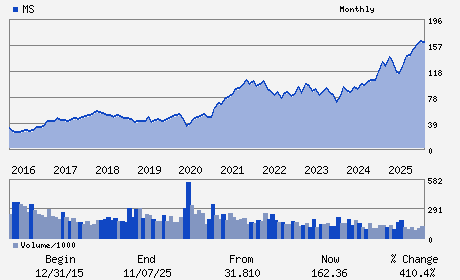

| • Price / Volume Information |

| Yesterday's Closing Price: $166.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 7,879,137 shares |

| Shares Outstanding: 1,587.86 (millions) |

| Market Capitalization: $264,394.59 (millions) |

| Beta: 1.20 |

| 52 Week High: $192.68 |

| 52 Week Low: $94.33 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.91% |

-8.11% |

| 12 Week |

-5.67% |

-5.78% |

| Year To Date |

-6.21% |

-6.66% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1585 BROADWAY

-

NEW YORK,NY 10036

USA |

ph: 212-761-4000

fax: 212-761-0086 |

None |

http://www.morganstanley.com |

|

|

| |

| • General Corporate Information |

Officers

Edward Pick - Chairman and Chief Executive Officer

Sharon Yeshaya - Executive Vice President and Chief Financial Offic

Victoria Worster - Chief Accounting Officer and Controller

Megan Butler - Director

Thomas H. Glocer - Director

|

|

Peer Information

Morgan Stanley (HDHL)

Morgan Stanley (AGE.)

Morgan Stanley (DIR)

Morgan Stanley (SIEB)

Morgan Stanley (OPY)

Morgan Stanley (FFGI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-INVEST BKRS

Sector: Finance

CUSIP: 617446448

SIC: 6211

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/15/26

|

|

Share - Related Items

Shares Outstanding: 1,587.86

Most Recent Split Date: 1.00 (2.00:1)

Beta: 1.20

Market Capitalization: $264,394.59 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.40% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.89 |

Indicated Annual Dividend: $4.00 |

| Current Fiscal Year EPS Consensus Estimate: $11.09 |

Payout Ratio: 0.39 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: -0.05 |

| Estmated Long-Term EPS Growth Rate: 11.20% |

Last Dividend Paid: 01/30/2026 - $1.00 |

| Next EPS Report Date: 04/15/26 |

|

|

|

| |