| Zacks Company Profile for MasTec, Inc. (MTZ : NYSE) |

|

|

| |

| • Company Description |

| MasTec is a leading infrastructure construction company. It engages in the engineering, building, installation, maintenance & upgrade of energy, communication & utility and other infrastructure. Its Communications unit performs engineering, construction & maintenance of communications infrastructure mainly related to wireless & wireline communications & install-to-the-home. Oil & Gas unit performs engineering, construction & maintenance services on oil & natural gas pipelines & processing facilities for the energy & utilities industries. Electrical Transmission unit primarily serves the energy & utility industries through the engineering, construction & maintenance of electrical transmission lines & substations. Clean Energy & Infrastructure unit primarily serves the energy & utility end-markets & other end-markets through the installation & construction of conventional & renewable power plants, related electrical transmission infrastructure, ethanol facilities & various types of industrial infrastructure.

Number of Employees: 36,000 |

|

|

| |

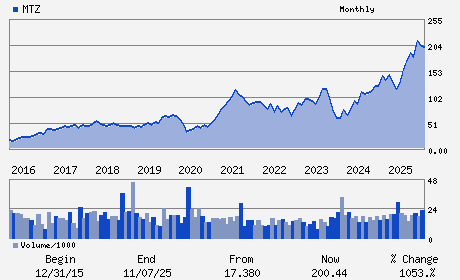

| • Price / Volume Information |

| Yesterday's Closing Price: $298.02 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 975,822 shares |

| Shares Outstanding: 78.90 (millions) |

| Market Capitalization: $23,514.05 (millions) |

| Beta: 1.88 |

| 52 Week High: $300.00 |

| 52 Week Low: $99.70 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

23.93% |

25.01% |

| 12 Week |

35.76% |

35.59% |

| Year To Date |

37.10% |

36.44% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jose R. Mas - Chief Executive Officer and Director

Jorge Mas - Chairman of the Board of Directors

Paul DiMarco - Executive Vice President and Chief Financial Offic

C. Robert Campbell - Director

Ernst N. Csiszar - Director

|

|

Peer Information

MasTec, Inc. (DBCOQ)

MasTec, Inc. (PHOE)

MasTec, Inc. (UNTKQ)

MasTec, Inc. (MTZ)

MasTec, Inc. (CBI)

MasTec, Inc. (GMDBY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-HEAVY CNST

Sector: Construction

CUSIP: 576323109

SIC: 1623

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 78.90

Most Recent Split Date: 6.00 (1.50:1)

Beta: 1.88

Market Capitalization: $23,514.05 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.64 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $7.97 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |