| Zacks Company Profile for My Size, Inc. (MYSZ : NSDQ) |

|

|

| |

| • Company Description |

| My Size, Inc. is involved in the development of applications for apparel businesses. It offers MySize ID, an application which enables consumers to create a secure, online profile of their personal measurements to get the right fit. My Size, Inc. is based in Airport City, Israel.

Number of Employees: 13 |

|

|

| |

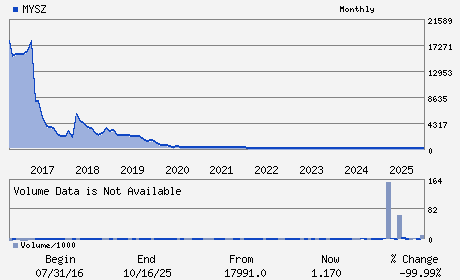

| • Price / Volume Information |

| Yesterday's Closing Price: $0.55 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 50,503 shares |

| Shares Outstanding: 3.85 (millions) |

| Market Capitalization: $2.12 (millions) |

| Beta: -0.25 |

| 52 Week High: $2.05 |

| 52 Week Low: $0.50 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-28.96% |

-28.34% |

| 12 Week |

-42.86% |

-42.93% |

| Year To Date |

-27.32% |

-27.67% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

HANEGEV 4. POB 1026

-

AIRPORT CITY,L3 7010000

ISR |

ph: 972-3600-9030

fax: - |

ir@mysizeid.com |

http://www.mysizeid.com |

|

|

| |

| • General Corporate Information |

Officers

Ronen Luzon - Chief Executive Officer and Director

Billy Pardo - Chief Operating Officer and Chief Product Officer

Or Kles - Chief Financial Officer

Roy Golan - Director

Arik Kaufman - Director

|

|

Peer Information

My Size, Inc. (ADP)

My Size, Inc. (CWLD)

My Size, Inc. (CYBA.)

My Size, Inc. (ZVLO)

My Size, Inc. (AZPN)

My Size, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 62844N406

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/26/26

|

|

Share - Related Items

Shares Outstanding: 3.85

Most Recent Split Date: 4.00 (0.13:1)

Beta: -0.25

Market Capitalization: $2.12 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-2.70 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/26/26 |

|

|

|

| |