| Zacks Company Profile for Nelnet, Inc. (NNI : NYSE) |

|

|

| |

| • Company Description |

| Nelnet Inc is an educational finance companies and is focused on providing quality student loan products and services to students and schools nationwide. Nelnet offers a broad range of student loan and financial services and technology-based products, including student loan origination and lending, guarantee servicing, and a suite of software solutions. Their products are designed to simplify the student loan process by automating financial aid delivery, loan processing, and funds disbursement.

Number of Employees: 6,739 |

|

|

| |

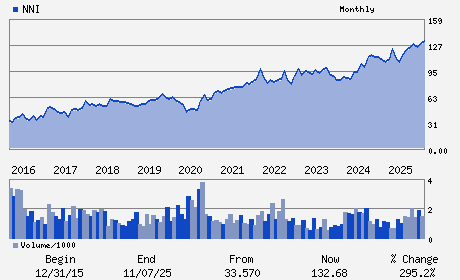

| • Price / Volume Information |

| Yesterday's Closing Price: $129.46 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 93,891 shares |

| Shares Outstanding: 35.93 (millions) |

| Market Capitalization: $4,651.90 (millions) |

| Beta: 0.82 |

| 52 Week High: $142.87 |

| 52 Week Low: $98.15 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.85% |

-0.99% |

| 12 Week |

-0.78% |

-0.90% |

| Year To Date |

-2.63% |

-3.10% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jeffrey R. Noordhoek - Chief Executive Officer

Michael S. Dunlap - Executive Chairman

James D. Kruger - Chief Financial Officer

Preeta D. Bansal - Director

Matthew W. Dunlap - Director

|

|

Peer Information

Nelnet, Inc. (EZPW)

Nelnet, Inc. (FPLPY)

Nelnet, Inc. (FMACQ)

Nelnet, Inc. (ASFI)

Nelnet, Inc. (ACAR.)

Nelnet, Inc. (HI.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-CONS LOANS

Sector: Finance

CUSIP: 64031N108

SIC: 6141

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 35.93

Most Recent Split Date: (:1)

Beta: 0.82

Market Capitalization: $4,651.90 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.02% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.32 |

| Current Fiscal Year EPS Consensus Estimate: $8.81 |

Payout Ratio: 0.11 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.07 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/27/2026 - $0.66 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |