| Zacks Company Profile for NI Holdings, Inc. (NODK : NSDQ) |

|

|

| |

| • Company Description |

| NI Holdings, Inc. provides property and casualty insurance products and services as well as retirement funding, estate strategies, education planning and annuities. NI Holdings, Inc. is based in FARGO, United States.

Number of Employees: 216 |

|

|

| |

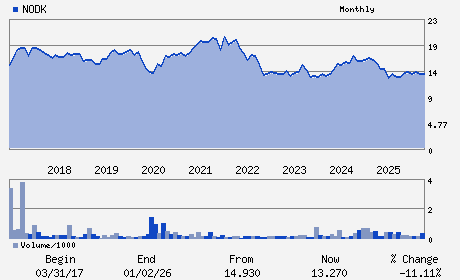

| • Price / Volume Information |

| Yesterday's Closing Price: $13.28 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 11,947 shares |

| Shares Outstanding: 20.61 (millions) |

| Market Capitalization: $273.64 (millions) |

| Beta: 0.39 |

| 52 Week High: $14.90 |

| 52 Week Low: $12.01 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.50% |

-1.64% |

| 12 Week |

0.15% |

0.03% |

| Year To Date |

-0.15% |

-0.63% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Seth C. Daggett - President and Chief Executive Officer

Matthew J. Maki - Chief Financial Officer

Eric K. Aasmundstad - Director

William R. Devlin - Director

Duaine C. Espegard - Director

|

|

Peer Information

NI Holdings, Inc. (CNA)

NI Holdings, Inc. (BRK.A)

NI Holdings, Inc. (CGI.)

NI Holdings, Inc. (HIGPQ)

NI Holdings, Inc. (HIG)

NI Holdings, Inc. (ALL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-PROP&CASLTY

Sector: Finance

CUSIP: 65342T106

SIC: 6331

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/06/26

|

|

Share - Related Items

Shares Outstanding: 20.61

Most Recent Split Date: (:1)

Beta: 0.39

Market Capitalization: $273.64 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/06/26 |

|

|

|

| |