| Zacks Company Profile for Nokia Corporation (NOK : NYSE) |

|

|

| |

| • Company Description |

| The core business of Nokia is telecommunication. Nokia mainly has four reportable segments' Mobile Networks, Network Infrastructure, Cloud and Network Services & Nokia Technologies. Mobile Networks includes mobile network products, network deployment and technical support services and related network management. It offers the full portfolio for customers who want to buy mobile access networks. It targets leadership in key technologies such as 5G, ORAN and vRAN. Network Infrastructure: Under this, Nokia provides net sales disclosure for Fixed Networks, IP Networks, Optical Networks and Submarine Networks. Cloud & Network Services includes the Nokia Software business, Nokia's enterprise solutions, core network solutions including both voice and packet core, and managed and advanced services from its Global Services unit. Nokia Technologies includes diverse technology features designed to bring the human family closer together.

Number of Employees: 80,361 |

|

|

| |

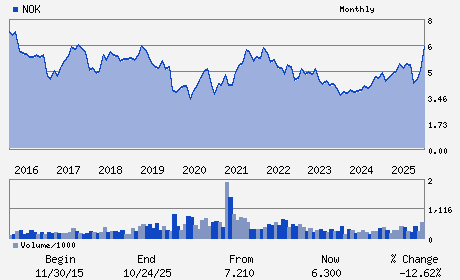

| • Price / Volume Information |

| Yesterday's Closing Price: $7.72 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 36,094,572 shares |

| Shares Outstanding: 5,742.24 (millions) |

| Market Capitalization: $44,330.09 (millions) |

| Beta: 0.79 |

| 52 Week High: $8.19 |

| 52 Week Low: $4.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

20.06% |

21.11% |

| 12 Week |

27.18% |

27.03% |

| Year To Date |

19.32% |

18.74% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Pekka Ilmari Lundmark - President and Chief Executive Officer

Sari Baldauf - Chairman

Soren Skou - Vice Chairman

Stephan Prosi - Vice President

Timo Ahopelto - Director

|

|

Peer Information

Nokia Corporation (CMTL)

Nokia Corporation (UMAC)

Nokia Corporation (ANEN)

Nokia Corporation (ERIC)

Nokia Corporation (CLUS)

Nokia Corporation (BKTI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Wireless Equipment

Sector: Computer and Technology

CUSIP: 654902204

SIC: 3663

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 5,742.24

Most Recent Split Date: 4.00 (4.00:1)

Beta: 0.79

Market Capitalization: $44,330.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.23% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.06 |

Indicated Annual Dividend: $0.09 |

| Current Fiscal Year EPS Consensus Estimate: $0.37 |

Payout Ratio: 0.25 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.09 |

| Estmated Long-Term EPS Growth Rate: 7.47% |

Last Dividend Paid: 02/03/2026 - $0.02 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |