| Zacks Company Profile for Northland Power, Inc. (NPIFF : OTC) |

|

|

| |

| • Company Description |

| Northland Power Inc. is a power producer. It involved in developing, building, owning and operating a diversified mix of energy infrastructure assets including offshore and onshore wind, solar, battery energy storage and natural gas. Northland Power Inc. is based in TORONTO.

Number of Employees: |

|

|

| |

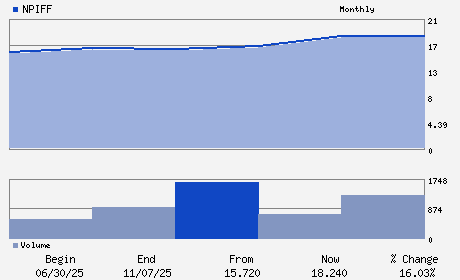

| • Price / Volume Information |

| Yesterday's Closing Price: $15.98 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 108,636 shares |

| Shares Outstanding: 261.50 (millions) |

| Market Capitalization: $4,178.77 (millions) |

| Beta: |

| 52 Week High: $18.44 |

| 52 Week Low: $11.43 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

15.84% |

16.85% |

| 12 Week |

28.25% |

28.09% |

| Year To Date |

22.83% |

22.23% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Christine Healy - Chief Executive Officer and President

John W. Brace - Chair of the Board and Director

Adam Beaumont - Interim Chief Financial Officer

Yonni Fushman - Chief Administrative & Legal Officer and Corporate

Lisa Colnett - Director

|

|

Peer Information

Northland Power, Inc. (APWR)

Northland Power, Inc. (USFCQ)

Northland Power, Inc. (SGII.)

Northland Power, Inc. (APGI)

Northland Power, Inc. (HYDP)

Northland Power, Inc. (FCEL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Other Alt Energy

Sector: Oils/Energy

CUSIP: 666511100

SIC: -

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/12/26

|

|

Share - Related Items

Shares Outstanding: 261.50

Most Recent Split Date: (:1)

Beta:

Market Capitalization: $4,178.77 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.28% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.52 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.45 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.33 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/27/2026 - $0.12 |

| Next EPS Report Date: 05/12/26 |

|

|

|

| |