| Zacks Company Profile for Naspers Ltd. (NPSNY : OTC) |

|

|

| |

| • Company Description |

| Naspers Limited is a multinational media group with its principal operations in pay television and Internet subscriber platforms, print media, book publishing, private education and technology markets. The group's activities are conducted through subsidiaries, joint ventures and associated companies. Naspers' most significant operations are located in South Africa, and it has major operations elsewhere in Africa, as well as in Greece, Cyprus and Asia.

Number of Employees: 27,010 |

|

|

| |

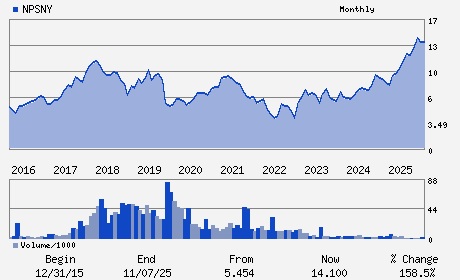

| • Price / Volume Information |

| Yesterday's Closing Price: $11.18 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 217,189 shares |

| Shares Outstanding: 3,947.18 (millions) |

| Market Capitalization: $44,129.41 (millions) |

| Beta: 0.45 |

| 52 Week High: $15.15 |

| 52 Week Low: $8.34 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-9.77% |

-8.98% |

| 12 Week |

-11.13% |

-11.24% |

| Year To Date |

-15.94% |

-16.35% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Fabricio Bloisi - Chief Executive Officer and Executive Director

Koos Bekker - Chairman

Nico Marais - Chief Financial Officer

Lynelle Bagwandeen - Company secretary

Phuthi Mahanyele-Dabengwa - Director

|

|

Peer Information

Naspers Ltd. (CMCSK)

Naspers Ltd. (CMCSA)

Naspers Ltd. (T.CH)

Naspers Ltd. (NCNXQ)

Naspers Ltd. (T.CSQ)

Naspers Ltd. (AMCM)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CABLE TV

Sector: Consumer Discretionary

CUSIP: 631512209

SIC: 7310

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 3,947.18

Most Recent Split Date: 10.00 (5.00:1)

Beta: 0.45

Market Capitalization: $44,129.41 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.32% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.04 |

| Current Fiscal Year EPS Consensus Estimate: $0.88 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 20.68% |

Last Dividend Paid: 12/11/2025 - $0.04 |

| Next EPS Report Date: - |

|

|

|

| |