| Zacks Company Profile for Nutrien Ltd. (NTR : NYSE) |

|

|

| |

| • Company Description |

| Nutrien Ltd. is a leading integrated provider of crop inputs and services. It supplies growers through its leading global Retail network. The company plays an important role in helping farmers around the world increase food production in a sustainable manner. It produces three crop nutrients - potash, nitrogen and phosphate. The company reports its results in four operating segments - Nutrien Ag Solutions, Potash, Nitrogen and Phosphate. Nutrien Ag Solutions: The segment distributes crop nutrients, crop protection products, seed, merchandise and agronomic application services and solutions through retail locations. Potash: The division engages in the mining and processing of potash, which is mainly used as a fertilizer. Nitrogen: The division produces nitrogen products from company-owned production facilities. Phosphate: The segment engages in the manufacture and distribution of solid and liquid phosphate fertilizers, phosphate feed and purified phosphoric acid used in feed and industrial products.

Number of Employees: 25,500 |

|

|

| |

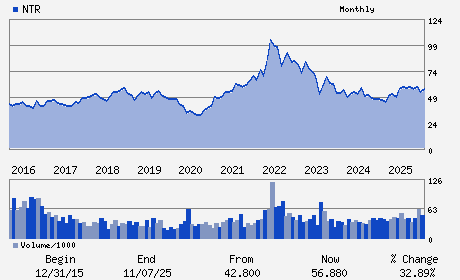

| • Price / Volume Information |

| Yesterday's Closing Price: $75.07 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,738,848 shares |

| Shares Outstanding: 481.14 (millions) |

| Market Capitalization: $36,119.28 (millions) |

| Beta: 0.70 |

| 52 Week High: $75.73 |

| 52 Week Low: $45.78 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.97% |

9.92% |

| 12 Week |

24.41% |

24.26% |

| Year To Date |

21.63% |

21.04% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ken A. Seitz - President and Chief Executive Officer

Russell Girling - Chairman

Jeff Tarsi - Executive Vice President and President

Mark Thompson - Executive Vice President and Chief Financial Offic

Noralee Bradley - Executive Vice President; External Affairs and Leg

|

|

Peer Information

Nutrien Ltd. (ESSI.)

Nutrien Ltd. (CF)

Nutrien Ltd. (TRA)

Nutrien Ltd. (CBLUY)

Nutrien Ltd. (NTR)

Nutrien Ltd. (TNH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FERTILIZERS

Sector: Basic Materials

CUSIP: 67077M108

SIC: 2870

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 481.14

Most Recent Split Date: 1.00 (0.40:1)

Beta: 0.70

Market Capitalization: $36,119.28 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.90% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.40 |

Indicated Annual Dividend: $2.18 |

| Current Fiscal Year EPS Consensus Estimate: $4.64 |

Payout Ratio: 0.51 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.05 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/31/2025 - $0.55 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |