| Zacks Company Profile for NVR, Inc. (NVR : NYSE) |

|

|

| |

| • Company Description |

| NVR, Inc. is engaged in the construction and sale of single-family detached homes, townhomes and condominium buildings, all of which are primarily constructed on a pre-sold basis. In order to serve homebuilding customers, the company operates a mortgage banking and title services business. The company operates in two business segments:? Homebuilding and Mortgage Banking. The homebuilding division builds and sells homes under three brand names - Ryan Homes, NVHomes and Heartland Homes. The two trade names - NVHomes and Heartland Homes, are mainly for move-up and upscale buyers. NVR's Mortgage Banking provides mortgage-related services to home-building customers through its mortgage banking operations. These services are operated primarily through a wholly owned subsidiary, NVR Mortgage Finance, Inc.

Number of Employees: 6,300 |

|

|

| |

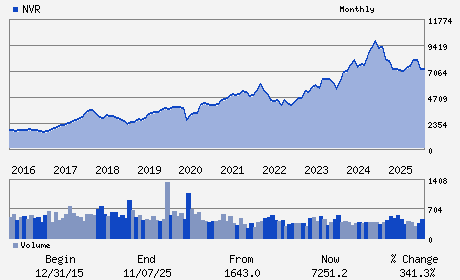

| • Price / Volume Information |

| Yesterday's Closing Price: $7,517.79 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 25,139 shares |

| Shares Outstanding: 2.79 (millions) |

| Market Capitalization: $21,002.90 (millions) |

| Beta: 1.04 |

| 52 Week High: $8,618.28 |

| 52 Week Low: $6,562.85 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.54% |

-0.68% |

| 12 Week |

-0.27% |

-0.39% |

| Year To Date |

3.09% |

2.59% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

11700 PLAZA AMERICA DR. SUITE 500

-

RESTON,VA 20190

USA |

ph: 703-956-4000

fax: 703-956-4750 |

ir@nvrinc.com |

http://www.nvrinc.com |

|

|

| |

| • General Corporate Information |

Officers

Eugene J. Bredow - President and Chief Executive Officer

Paul C. Saville - Executive Chairman of the Board

Daniel D. Malzahn - Senior Vice President; Chief Financial Officer and

Matthew B. Kelpy - Vice President and Chief Accounting Officer

Sallie B. Bailey - Director

|

|

Peer Information

NVR, Inc. (CLPO)

NVR, Inc. (IAHM)

NVR, Inc. (HLCO)

NVR, Inc. (ENGEF)

NVR, Inc. (BZH)

NVR, Inc. (CSHHY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-RSDNT/COMR

Sector: Construction

CUSIP: 62944T105

SIC: 1531

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/28/26

|

|

Share - Related Items

Shares Outstanding: 2.79

Most Recent Split Date: 10.00 (0.03:1)

Beta: 1.04

Market Capitalization: $21,002.90 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $81.66 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $413.28 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 7.04% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/28/26 |

|

|

|

| |