| Zacks Company Profile for The New York Times Company (NYT : NYSE) |

|

|

| |

| • Company Description |

| The New York Times Company (NYT) operates as a diversified media company that comprises newspapers, Internet businesses and other investments. The company has one reportable segment that comprise newspaper, The New York Times ('The Times'); websites, including NYTimes.com; mobile applications, including The Times's core news applications, as well as interest-specific applications, including Crossword and Cooking products; and related businesses, such as licensing division; digital marketing agencies; product review and recommendation website, Wirecutter; commercial printing operations; NYT Live (live events business); and other products and services under The Times brand.

Number of Employees: 5,900 |

|

|

| |

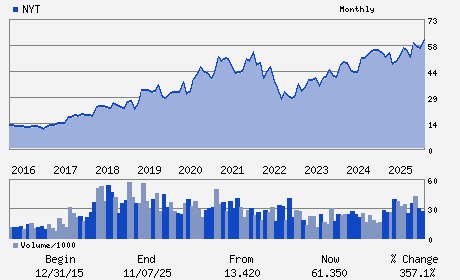

| • Price / Volume Information |

| Yesterday's Closing Price: $79.79 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,178,230 shares |

| Shares Outstanding: 162.35 (millions) |

| Market Capitalization: $12,953.83 (millions) |

| Beta: 1.09 |

| 52 Week High: $79.91 |

| 52 Week Low: $44.83 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.84% |

9.79% |

| 12 Week |

23.23% |

23.08% |

| Year To Date |

14.94% |

14.38% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Meredith Kopit Levien - Chief Executive Officer; President and Director

A.G. Sulzberger - Chairman; Publisher and Director

William Bardeen - Executive Vice President and Chief Financial Offic

R. Anthony Benten - Senior Vice President; Treasurer and Chief Account

Amanpal S. Bhutani - Director

|

|

Peer Information

The New York Times Company (SUTMQ)

The New York Times Company (GCI.)

The New York Times Company (DJCO)

The New York Times Company (NWCM)

The New York Times Company (PTZ)

The New York Times Company (LEE)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: PUBLSHG-NEWSPRS

Sector: Consumer Staples

CUSIP: 650111107

SIC: 2711

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 162.35

Most Recent Split Date: 7.00 (2.00:1)

Beta: 1.09

Market Capitalization: $12,953.83 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.90% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.49 |

Indicated Annual Dividend: $0.72 |

| Current Fiscal Year EPS Consensus Estimate: $2.73 |

Payout Ratio: 0.29 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 11.81% |

Last Dividend Paid: 01/06/2026 - $0.18 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |