| Zacks Company Profile for Ollie's Bargain Outlet Holdings, Inc. (OLLI : NSDQ) |

|

|

| |

| • Company Description |

| Ollie's Bargain Outlet Holdings, Inc. is a value retailer of brand name merchandise at drastically reduced prices. The company offers products principally under Ollie's, Ollie's Bargain Outlet, Good Stuff Cheap, Ollie's Army, Real Brands Real Cheap!, Real Brands! Real Bargains!, Sarasota Breeze, Steelton Tools, American Way and Commonwealth Classics.

Number of Employees: 12,800 |

|

|

| |

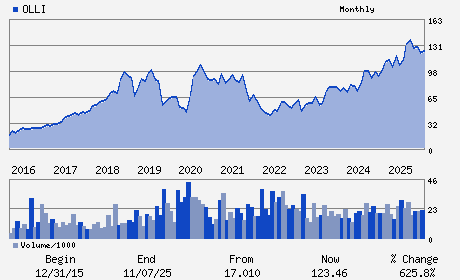

| • Price / Volume Information |

| Yesterday's Closing Price: $107.10 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 843,890 shares |

| Shares Outstanding: 61.33 (millions) |

| Market Capitalization: $6,568.72 (millions) |

| Beta: 0.53 |

| 52 Week High: $141.74 |

| 52 Week Low: $97.04 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.91% |

-2.06% |

| 12 Week |

-11.73% |

-11.84% |

| Year To Date |

-2.29% |

-2.76% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

6295 ALLENTOWN BOULEVARD SUITE 1

-

HARRISBURG,PA 17112

USA |

ph: 717-657-2300

fax: - |

jrouleau@ollies.us |

http://www.ollies.us |

|

|

| |

| • General Corporate Information |

Officers

Eric van der Valk - President and Chief Executive Officer

John Swygert - Executive Chairman

Robert Helm - Executive Vice President and Chief Financial Offic

Alissa Ahlman - Director

Mary Baglivo - Director

|

|

Peer Information

Ollie's Bargain Outlet Holdings, Inc. (EPC)

Ollie's Bargain Outlet Holdings, Inc. (HPPS)

Ollie's Bargain Outlet Holdings, Inc. (ADRNY)

Ollie's Bargain Outlet Holdings, Inc. (YHGJ)

Ollie's Bargain Outlet Holdings, Inc. (GPSYY)

Ollie's Bargain Outlet Holdings, Inc. (HENKY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONS PD- MISC STPL

Sector: Consumer Staples

CUSIP: 681116109

SIC: 5331

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/12/26

|

|

Share - Related Items

Shares Outstanding: 61.33

Most Recent Split Date: (:1)

Beta: 0.53

Market Capitalization: $6,568.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.87 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $4.47 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 14.63% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/12/26 |

|

|

|

| |