| Zacks Company Profile for Ouster, Inc. (OUST : NSDQ) |

|

|

| |

| • Company Description |

| Ouster Inc. is a provider of high-resolution digital lidar sensors for industrial automation, robotics, smart infrastructure and automotive industries. Ouster Inc., formerly known as Colonnade Acquisition Corp., is based in SAN FRANCISCO.

Number of Employees: 192 |

|

|

| |

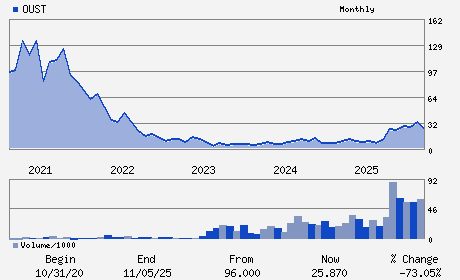

| • Price / Volume Information |

| Yesterday's Closing Price: $18.95 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,516,889 shares |

| Shares Outstanding: 60.01 (millions) |

| Market Capitalization: $1,137.09 (millions) |

| Beta: 2.91 |

| 52 Week High: $41.65 |

| 52 Week Low: $6.34 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-19.29% |

-18.24% |

| 12 Week |

-27.09% |

-27.32% |

| Year To Date |

-12.43% |

-10.12% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Angus Pacala - Director; Co-Founder and Chief Executive Officer

Theodore Tewksbury - Chair of the Board of Director

Darien Spencer - Chief Operating Officer

Chen Geng - Interim Chief Financial Officer

Stephen A. Skaggs - Director

|

|

Peer Information

Ouster, Inc. (SMTI.)

Ouster, Inc. (DDICQ)

Ouster, Inc. (CGGIQ)

Ouster, Inc. (CRDN)

Ouster, Inc. (CDTS)

Ouster, Inc. (AURAQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MISC COMPONENTS

Sector: Computer and Technology

CUSIP: 68989M202

SIC: 3569

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/02/26

|

|

Share - Related Items

Shares Outstanding: 60.01

Most Recent Split Date: 4.00 (0.10:1)

Beta: 2.91

Market Capitalization: $1,137.09 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-1.16 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/02/26 |

|

|

|

| |