| Zacks Company Profile for Palo Alto Networks, Inc. (PANW : NSDQ) |

|

|

| |

| • Company Description |

| Palo Alto Networks, Inc. offers network security solutions to enterprises, service providers and government entities worldwide. The company's next generation firewall products deliver natively integrated application, user, and content visibility and control through its operating system, hardware and software architecture. It serves the enterprise network security market, which includes Firewall, Unified Threat Management, Web Gateway, Intrusion Detection and Prevention and Virtual Private Network technologies. Through its products and subscription services, Palo Alto provides integrated protection against dynamic security threats while simplifying the IT security infrastructure. Its solutions incorporate application-specific integrated circuits, hardware architecture, operating system, and associated security and networking functions. The company's network security gateways protect customer data, reduce security complexities and lower total cost of ownership.

Number of Employees: 16,068 |

|

|

| |

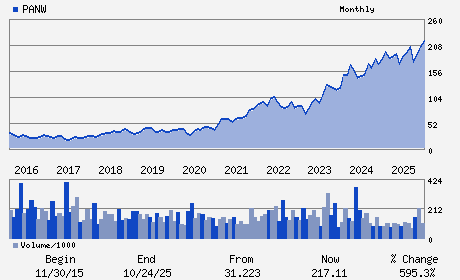

| • Price / Volume Information |

| Yesterday's Closing Price: $148.92 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 16,752,104 shares |

| Shares Outstanding: 816.00 (millions) |

| Market Capitalization: $121,518.72 (millions) |

| Beta: 0.78 |

| 52 Week High: $223.61 |

| 52 Week Low: $139.57 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-15.85% |

-15.11% |

| 12 Week |

-25.11% |

-25.20% |

| Year To Date |

-19.15% |

-19.55% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Nikesh Arora - Chief Executive Officer; Chairman and Director

Dipak Golechha - Chief Financial Officer

Aparna Bawa - Director

John M. Donovan - Director

Carl Eschenbach - Director

|

|

Peer Information

Palo Alto Networks, Inc. (CHKP)

Palo Alto Networks, Inc. (ABST)

Palo Alto Networks, Inc. (ZIXI)

Palo Alto Networks, Inc. (FTNT)

Palo Alto Networks, Inc. (GUID)

Palo Alto Networks, Inc. (VRNS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Security

Sector: Computer and Technology

CUSIP: 697435105

SIC: 3577

|

|

Fiscal Year

Fiscal Year End: July

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/19/26

|

|

Share - Related Items

Shares Outstanding: 816.00

Most Recent Split Date: 12.00 (2.00:1)

Beta: 0.78

Market Capitalization: $121,518.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.43 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.13 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 20.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 12.98% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/19/26 |

|

|

|

| |