| Zacks Company Profile for PCB Bancorp (PCB : NSDQ) |

|

|

| |

| • Company Description |

| PCB Bancorp is a bank holding company which, through its subsidiaries, offers savings accounts, debit and credit cards, personal and business loans, cash management, certificate of deposits, online banking, mortgages, wealth management and e-statements. PCB Bancorp, formerly known as Pacific City Financial Corp, is based in Los Angeles, United States.

Number of Employees: 263 |

|

|

| |

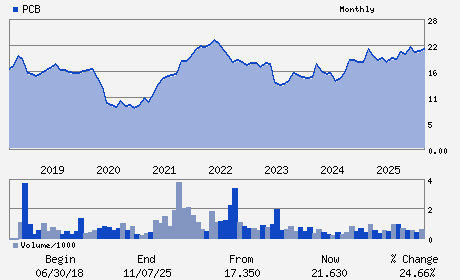

| • Price / Volume Information |

| Yesterday's Closing Price: $22.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 25,176 shares |

| Shares Outstanding: 14.26 (millions) |

| Market Capitalization: $318.88 (millions) |

| Beta: 0.58 |

| 52 Week High: $24.20 |

| 52 Week Low: $16.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.54% |

2.87% |

| 12 Week |

2.57% |

2.24% |

| Year To Date |

3.28% |

4.71% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3701 WILSHIRE BLVD SUITE 900

-

LOS ANGELES,CA 90010

USA |

ph: 213-210-2000

fax: 213-210-2032 |

None |

http://www.mypcbbank.com |

|

|

| |

| • General Corporate Information |

Officers

Henry Kim - Director; President and Chief Executive Officer

Sang Young Lee - Chairman of the Board of Directors

Timothy Chang - Executive Vice President and Chief Financial Offic

Kijun Ahn - Director

Daniel Cho - Director

|

|

Peer Information

PCB Bancorp (FBA)

PCB Bancorp (FVNB)

PCB Bancorp (FSNMQ)

PCB Bancorp (SRYPQ)

PCB Bancorp (BOKF)

PCB Bancorp (FHN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHWEST

Sector: Finance

CUSIP: 69320M109

SIC: 6022

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 14.26

Most Recent Split Date: (:1)

Beta: 0.58

Market Capitalization: $318.88 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.94% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.67 |

Indicated Annual Dividend: $0.88 |

| Current Fiscal Year EPS Consensus Estimate: $2.81 |

Payout Ratio: 0.31 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/13/2026 - $0.22 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |