| Zacks Company Profile for Pro-Dex, Inc. (PDEX : NSDQ) |

|

|

| |

| • Company Description |

| Pro-Dex Inc., with operations in Santa Ana, California, Beaverton, Oregon and Carson City Nevada, specializes in bringing speed to market in the development and manufacture of technology-based solutions that incorporate embedded motion control, miniature rotary drive systems and fractional horsepower DC motors, serving the medical, dental, semi-conductor, scientific research and aerospace markets. Pro-Dex's products are found in hospitals, dental offices, medical engineering labs, scientific research facilities, commercial and military aircraft, and high tech manufacturing operations globally.

Number of Employees: 181 |

|

|

| |

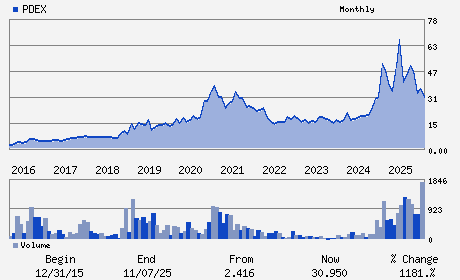

| • Price / Volume Information |

| Yesterday's Closing Price: $44.31 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 24,962 shares |

| Shares Outstanding: 3.21 (millions) |

| Market Capitalization: $142.06 (millions) |

| Beta: -0.05 |

| 52 Week High: $70.26 |

| 52 Week Low: $23.47 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.45% |

13.92% |

| 12 Week |

8.87% |

8.53% |

| Year To Date |

15.15% |

15.05% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Richard L. Van Kirk - Chief Executive Officer and President

Nicholas J. Swenson - Chairman

Alisha K. Charlton - Chief Financial Officer

Raymond E. Cabillot - Director

Angelita R. Domingo - Director

|

|

Peer Information

Pro-Dex, Inc. (ITRJ)

Pro-Dex, Inc. (BRLI.)

Pro-Dex, Inc. (GOGY)

Pro-Dex, Inc. (PSTX.)

Pro-Dex, Inc. (ELGXQ)

Pro-Dex, Inc. (CAH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED/DENTAL-SUPP

Sector: Medical

CUSIP: 74265M205

SIC: 3841

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 3.21

Most Recent Split Date: 6.00 (0.33:1)

Beta: -0.05

Market Capitalization: $142.06 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |