| Zacks Company Profile for Precigen, Inc. (PGEN : NSDQ) |

|

|

| |

| • Company Description |

| Precigen Inc. is a biopharmaceutical company. It specialise in the development of gene and cell therapies for immuno-oncology, autoimmune disorders and infectious diseases. The company's transformative therapeutic platforms, including UltraCAR-T(TM), AdenoVerse(TM) cytokine therapies, multifunctional therapeutics and off-the-shelf AdenoVerse(TM) immunotherapies, as well as ActoBio Therapeutics, Exemplar Genetics and Triple-Gene from our subsidiaries. Precigen Inc., formerly known as Intrexon Corporation, is based in Germantown, Maryland.

Number of Employees: 143 |

|

|

| |

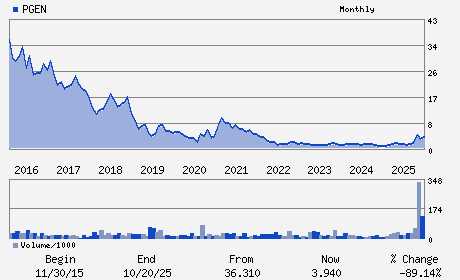

| • Price / Volume Information |

| Yesterday's Closing Price: $3.79 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,393,686 shares |

| Shares Outstanding: 353.83 (millions) |

| Market Capitalization: $1,340.99 (millions) |

| Beta: 1.10 |

| 52 Week High: $5.47 |

| 52 Week Low: $1.11 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-15.59% |

-14.85% |

| 12 Week |

5.28% |

5.15% |

| Year To Date |

-9.33% |

-9.77% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Helen Sabzevari - Chief Executive Officer

Randal J. Kirk - Executive Chairman

Harry Thomasian Jr. - Chief Financial Officer

Nancy H. Agee - Director

Cesar L. Alvarez - Director

|

|

Peer Information

Precigen, Inc. (CORR.)

Precigen, Inc. (RSPI)

Precigen, Inc. (CGXP)

Precigen, Inc. (BGEN)

Precigen, Inc. (GTBP)

Precigen, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 74017N105

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/18/26

|

|

Share - Related Items

Shares Outstanding: 353.83

Most Recent Split Date: (:1)

Beta: 1.10

Market Capitalization: $1,340.99 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.08 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.16 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/18/26 |

|

|

|

| |