| Zacks Company Profile for Paragon Technologies Inc. (PGNT : OTC) |

|

|

| |

| • Company Description |

| Paragon Technologies, Inc. is a leader in integrating material handling systems and creating automated solutions for material flow applications. The company's core systems capability is horizontal transportation and rapid dispensing. Ermanco is a pioneer in designing, manufacturing, and integrating conveyors and conveyor systems. One of the top material handling systems suppliers worldwide, Paragon's clients include General Motors, IBM, BMG, Daimler Chrysler, Johnson & Johnson, Ford, Peterbilt, Harley Davidson, McKesson, Walgreen, and Clark Equipment. (PRESS RELEASE)

Number of Employees: |

|

|

| |

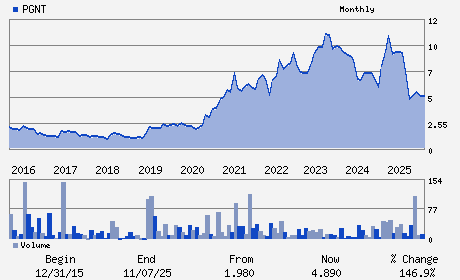

| • Price / Volume Information |

| Yesterday's Closing Price: $4.98 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 288 shares |

| Shares Outstanding: 1.76 (millions) |

| Market Capitalization: $8.75 (millions) |

| Beta: 0.37 |

| 52 Week High: $13.08 |

| 52 Week Low: $4.24 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.63% |

2.52% |

| 12 Week |

-6.04% |

-6.15% |

| Year To Date |

0.00% |

-0.49% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

600 KUEBLER ROAD

-

EASTON,PA 18040-9201

USA |

ph: 610-252-3205

fax: 610-252-3102 |

None |

http://www.ptgamex.com |

|

|

| |

| • General Corporate Information |

Officers

Theodore W. Myers - Chairman of the Board

Ronald J. Semanick - C.F.O.; Vice President - Finance; Treasurer; Secre

John F. Lehr - Vice President

Ronald J. Izewski - Director

Robert J. Schwartz - Director

|

|

Peer Information

Paragon Technologies Inc. (CMCO)

Paragon Technologies Inc. (CASC2)

Paragon Technologies Inc. (BZC)

Paragon Technologies Inc. (MCCL)

Paragon Technologies Inc. (KTEC.)

Paragon Technologies Inc. (DSCSY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-MATL HDLG

Sector: Industrial Products

CUSIP: 69912T108

SIC: 3530

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/30/26

|

|

Share - Related Items

Shares Outstanding: 1.76

Most Recent Split Date: 11.00 (1.50:1)

Beta: 0.37

Market Capitalization: $8.75 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/30/26 |

|

|

|

| |