| Zacks Company Profile for PLBY Group, Inc. (PLBY : NSDQ) |

|

|

| |

| • Company Description |

| PLBY Group Inc. is a pleasure and leisure lifestyle company. It serves consumers in categories which include Sexual Wellness, Style & Apparel, Gaming & Lifestyle and Beauty & Grooming. PLBY Group Inc., formerly known as Mountain Crest Acquisition Corp, is based in LOS ANGELES.

Number of Employees: 615 |

|

|

| |

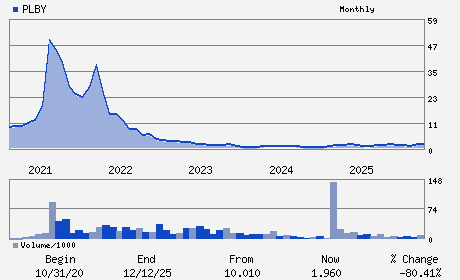

| • Price / Volume Information |

| Yesterday's Closing Price: $1.91 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,063,290 shares |

| Shares Outstanding: 107.76 (millions) |

| Market Capitalization: $205.82 (millions) |

| Beta: 2.66 |

| 52 Week High: $2.74 |

| 52 Week Low: $0.90 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

23.23% |

24.84% |

| 12 Week |

-12.39% |

-12.66% |

| Year To Date |

1.60% |

4.35% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ben Kohn - Chief Executive Officer; President and Director

Marc Crossman - Chief Financial Officer and Chief Operating Office

Suhail Rizvi - Director

Tracey Edmonds - Director

James Yaffe - Director

|

|

Peer Information

PLBY Group, Inc. (BAJAY)

PLBY Group, Inc. (ESCA)

PLBY Group, Inc. (GOYL)

PLBY Group, Inc. (FTSP)

PLBY Group, Inc. (KTO)

PLBY Group, Inc. (BOLL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC PRD

Sector: Consumer Discretionary

CUSIP: 72814P109

SIC: 5900

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/12/26

|

|

Share - Related Items

Shares Outstanding: 107.76

Most Recent Split Date: (:1)

Beta: 2.66

Market Capitalization: $205.82 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.02 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.11 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/12/26 |

|

|

|

| |