| Zacks Company Profile for PPG Industries, Inc. (PPG : NYSE) |

|

|

| |

| • Company Description |

| PPG Industries Inc., based in Pennsylvania, is a global supplier of paints, coatings, chemicals, specialty materials, glass and fiber glass. The company has manufacturing facilities and equity affiliates in about 70 countries. It currently has three reportable segments: Global Architectural Coatings, Performance Coatings and Industrial Coatings.

Number of Employees: 43,500 |

|

|

| |

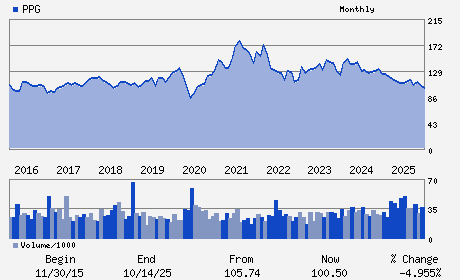

| • Price / Volume Information |

| Yesterday's Closing Price: $123.27 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,966,941 shares |

| Shares Outstanding: 223.49 (millions) |

| Market Capitalization: $27,550.19 (millions) |

| Beta: 1.15 |

| 52 Week High: $133.43 |

| 52 Week Low: $90.24 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.61% |

7.54% |

| 12 Week |

22.01% |

21.86% |

| Year To Date |

20.31% |

19.73% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Timothy M. Knavish - Chairman and Chief Executive Officer

Vincent J. Morales - Senior Vice President and Chief Financial Officer

Brian R. Williams - Vice President and Controller

K. L. Fortmann - Director

M. L. Healey - Director

|

|

Peer Information

PPG Industries, Inc. (CSBHY)

PPG Industries, Inc. (ARWM)

PPG Industries, Inc. (FUL)

PPG Industries, Inc. (IAX)

PPG Industries, Inc. (AVD)

PPG Industries, Inc. (ASH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-SPECIALTY

Sector: Basic Materials

CUSIP: 693506107

SIC: 2851

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 223.49

Most Recent Split Date: 6.00 (2.00:1)

Beta: 1.15

Market Capitalization: $27,550.19 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.30% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.72 |

Indicated Annual Dividend: $2.84 |

| Current Fiscal Year EPS Consensus Estimate: $8.02 |

Payout Ratio: 0.37 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 8.30% |

Last Dividend Paid: 02/20/2026 - $0.71 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |