| Zacks Company Profile for Patterson-UTI Energy, Inc. (PTEN : NSDQ) |

|

|

| |

| • Company Description |

| Patterson-UTI Energy, Inc. is an oilfield services company. It is one of the largest onshore contract drillers in the United States and has a large fleet of pressure pumping equipment. Patterson-UTI operates primarily in four segments: Contract Drilling , Pressure Pumping, Directional Drilling, and Others. The company is a major supplier of onshore drilling rigs on a contractual basis to explore for and develop oil and gas.

Number of Employees: 7,900 |

|

|

| |

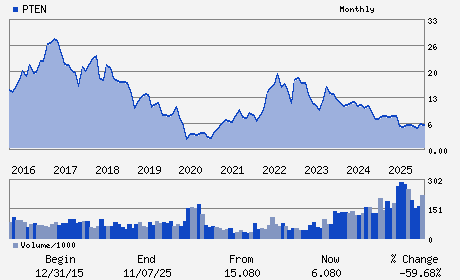

| • Price / Volume Information |

| Yesterday's Closing Price: $8.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 10,096,690 shares |

| Shares Outstanding: 379.58 (millions) |

| Market Capitalization: $3,230.19 (millions) |

| Beta: 0.71 |

| 52 Week High: $8.91 |

| 52 Week Low: $5.10 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

13.02% |

14.00% |

| 12 Week |

34.65% |

34.49% |

| Year To Date |

39.28% |

38.60% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

William Andrew Hendricks - Chief Executive Officer;President

Curtis W. Huff - Chairman of the Board

Robert W. Drummond - Vice Chairman of the Board

C. Andrew Smith - Chief Financial Officer;Executive Vice President

Forrest Robinson - Chief Accounting Officer

|

|

Peer Information

Patterson-UTI Energy, Inc. (DOFSQ)

Patterson-UTI Energy, Inc. (NBR)

Patterson-UTI Energy, Inc. (OKOK)

Patterson-UTI Energy, Inc. (PMESY)

Patterson-UTI Energy, Inc. (GW)

Patterson-UTI Energy, Inc. (GLM)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL&GAS-DRILL

Sector: Oils/Energy

CUSIP: 703481101

SIC: 1381

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 379.58

Most Recent Split Date: 7.00 (2.00:1)

Beta: 0.71

Market Capitalization: $3,230.19 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.76% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.10 |

Indicated Annual Dividend: $0.32 |

| Current Fiscal Year EPS Consensus Estimate: $-0.34 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/01/2025 - $0.08 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |